If a lender denies the application to have a normal financial because away from a reduced-than-primary credit score or ineffective downpayment, you’ll be able to think considering just what government-recognized money have to offer. These normally come with quicker strict creditworthiness and you may advance payment conditions, whilst you must see most other requirements.

https://paydayloanalabama.com/mosses/

- USDA funds. The newest You.S. Department of Agriculture (USDA) works as the an excellent guarantor of these finance. You may get an effective USDA financing to get property inside a rural area, a tiny city, or a qualified suburban city. These funds are great for reduced- and average-income applicants. They need zero down-payment.

- Va financing. Brand new Institution away from Veteran Issues guarantees such finance. You may want to sign up for a good Va mortgage while the a military experienced, a military affiliate with the productive obligation, a great reservist, or an eligible surviving companion. Such funds have zero down payment demands.

- FHA financing. Brand new Federal Construction Government (FHA) backs such finance. You can qualify for that which have a credit history once the reduced due to the fact five hundred. Based your credit score, it is possible to make a down payment away from 3.5% otherwise 10%,

Require less Amount

Instance, when you’re a lender could well be reluctant to provide your $750,000, you could potentially meet the requirements for people who search $600,000. Remember that your income possess a direct results into financing count in which you you are going to be considered, and that means you need to pay owed awareness of this point. If you imagine to buy a more affordable family otherwise can also be perform and make a much bigger down payment, you may also believe trying to get a new loan, albeit to possess a lot less.

The more money you can lay towards your down-payment, the fresh minimal you would like in the form of a home loan. Although this doesn’t make sure the approval of one’s second mortgage, it increases the odds of triumph. Really down payment recommendations applications have a tendency to favor basic-day homeowners, but this is not always the case.

You could potentially qualify for down-payment guidelines when you have low/modest income, there is no need worst creditworthiness, the debt-to-earnings (DTI) proportion is actually popular restrictions, while want to reside in our home you order.

Down payment guidance will come in the form of you to definitely-go out grants, matched-coupons apps, forgivable funds, and you will lower-desire funds. Cost words confidence the only for which you meet the requirements. Such as for instance, you don’t need to pay a forgivable financing if you’re at home you order to possess a fixed period of time that is typically upward of 5 years.

Score a great Co-Signer

When your home loan application is rejected on account of terrible creditworthiness otherwise not enough earnings, implementing having good co-signer who’s got a good credit score might work really for you. For the reason that mortgage providers imagine co-signers’ credit ratings and you can earnings when designing financing behavior. An effective co-signer’s good credit score might also lead to a lower notice rates. However, in search of good co-signer might not be effortless, since delivering a mortgage is typically a lengthy-name connection.

Hold back until Your Augment All Factors

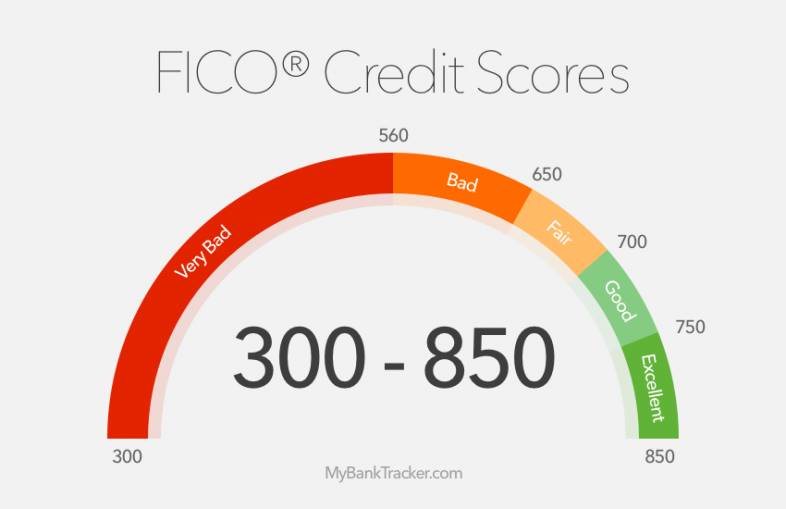

If you’ve tell you all your valuable choices, you have got not any other solution than to wait until your improve every problems that are remaining you against becoming a great homeowner. Particularly, if you have a reduced-than-preferred credit score, you should begin by getting hired in check, that will simply take a couple months, a year, or even stretched. If the earnings is the condition, you can also envision taking a second business. Without having adequate currency to help make the required down fee, you will have to start saving.

Completion

Applying for a home loan should be a daunting task, all the more very of the the inner workings involved in the process. Have a tendency to, not entry an important file might result when you look at the a lender denying your application. This is why, its crucial that you look at the well-known financial assertion grounds because offers the ability to improve possibility of your own application’s achievement.

No comment