Regarding refinancing, it is essential to consider carefully your specifications and also to recognize how far you might obtain. Before making one decisions, you ought to determine your situation to discover what kind away from refinancing usually most useful meet your needs.

Simply how much guarantee have you got on your own property? The amount of security you may have have a tendency to change the count your normally use.

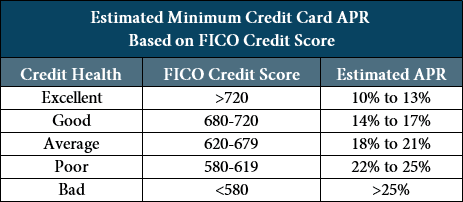

What is your credit score? Your credit rating and other things will establish the interest rate you might be able to safer.

Just how long can you intend to stay-in your existing family? This is very important as it tend to impact the brand of loan you can purchase therefore the matter you could potentially acquire.

The length of time do you need to support the loan? In case it is a longer-name loan, you happen to be able to acquire additional money.

After you have thought such facts, you will end up in the a better position to determine just how much you is also obtain. you will have the ability to exercise in the event the refinancing ‘s the best click to find out more choice for you.

It is very important consider the pros and drawbacks out-of refinancing prior to a decision. Ensure that you will be conscious of the newest related will set you back and you may charge, because these accumulates rapidly. When you find yourself refinancing can be useful in some cases, it is vital to understand the threats in it and make certain one to it will be the most readily useful ily

Choose the best Financial to you

Whenever refinancing their financial, you should choose a loan provider you to definitely is best suited for your means. Selecting the right bank is an important step in the fresh refinancing procedure that make a difference what you can do to repay their financial in a timely manner.

The initial step in selecting suitable lender is to try to examine pricing and you will charge. The interest rate you have to pay toward that loan is a vital cause of deciding on the best financial. Definitely look around and compare cost out of additional lenders to be certain you get a knowledgeable bargain you’ll be able to. Simultaneously, check out the style of charges that you might be energized because of the the financial institution. These are generally software charge, origination charge, and you can settlement costs. Many of these costs accumulates over time, so it is vital that you evaluate loan providers and know very well what your are investing.

An alternative factor to adopt when selecting a lender ‘s the financing conditions. Additional lenders may offer more financing terminology, such as the amount of the loan, the amount of the borrowed funds, otherwise additional features that can be advantageous to you. Consider your financial requires and determine and this financing terminology would be best for the situation.

The consumer solution supplied by the lending company is also extremely important. You should be able to communicate with the lender is to people factors develop. Make sure to browse customers critiques into the financial and make certain you feel comfortable with the customer service given.

In the long run, you should know the different style of financing provided by the fresh new bank. Different varieties of fund might have different rates, fees, and you may mortgage terms and conditions. Make sure you look into the various mortgage affairs supplied by the latest bank to see hence financing is perfect for your situation.

Whenever refinancing your own home loan, it is very important select the right bank. Definitely contrast rates and costs, believe loan terms, see support service, and you may remark the different loan situations given by the financial institution into the acquisition and make a knowledgeable choice and now have an informed deal

Achievement

When refinancing your house mortgage, it is vital to believe the items to determine exactly how much you could obtain. At home Financing Partners, we realize the causes out of refinancing and are also right here to aid your from processes. We can provide good advice toward most readily useful financing tool for the personal situations and provide you with an educated financing for the means.

No comment