DOWNLOAD OPTIONS

One of the main disadvantages is the increased transaction costs. It’s a cross between a long calendar spread with calls and a short call spread. Stock prices move as per demand and supply, economic reports, fundamental factors like company profitability and trader sentiment. You should consider several things while considering the best trading app in India. Swing traders can set stop loss orders and exit positions when the trend reverses. It’s split into two key segments: one for agricultural commodities and another for non agricultural ones. Create profiles for personalised advertising. It describes the drop of a security or index, a rebound, another drop to the same or similar level as the original drop, and finally another rebound that may become a new uptrend. Some professional traders even build their own software, especially for automated trading – even the best stock trading platforms aren’t good enough. And it provides tons of features and analysis tools. Your capital is at risk. Unlock your potential with The Knowledge Academy’s Stock Trading Masterclass Trading Training in Stockholm, accessible anytime, anywhere on any device. Powered by Invision Community. To improve your trading psychology, you must learn to manage your emotions effectively. Users hail its real time market data, charts and quick trade execution. It is an indept study of options concepts, terminologies, examples, and strategies. Using an investment app is a great way for beginner investors to start learning how to invest. In dark pools, trading takes place anonymously, with most orders hidden or “iceberged”. That’s because while purchasers of options have the right, but not the obligation, to exercise the options contract that they purchased, investors that sell—or write—contracts, have the obligation to buy or sell shares at the https://pocketoptionon.top/pt/assets-current/ strike price if assigned. BSE, along with the National Stock Exchange in India, are the two main houses where stock market trading takes place. You still need to know your markets, put in the work and make a clear trading plan if you want to become a successful trader. Beginners and advanced traders alike can benefit from the industry low fees and instant buy on more advanced trading platforms like Binance. Bajaj Financial Securities Limited or any of its associates / group companies shall not be in any way responsible for any loss or damage that may arise to any person from any inadvertent error in the information contained in this report. Apple iOS and Android.

Open Source Financial Technology, Paving the Future of Trading

Raj Rajaratnam made about $60 million as a billionaire hedge fund manager by swapping tips with other traders, hedge fund managers, and key employees of IBM, Intel Corp, and McKinsey and Co. Although some of these techniques were mentioned above, they are worth going into again. As for the cybersecurity of the app itself, you can always make sure your trading remains as safe and secure as possible by turning on two factor authentication, keeping your mobile phone software up to date, enable biometric access like FaceID/TouchID, and use a strong password that’s not reused elsewhere. Similarly, if you think XYZ’s share price is going to dip to $80, you could buy a put option giving you the right to sell shares with a strike price above $80 ideally a strike price no lower than $80 plus the cost of the option, so that the option remains profitable at $80. During the trial period, you will get full access to the platform’s tools to experiment with tick and other volumes. Gain basic to intermediate Excel skills, review corporate finance and financial accounting concepts, and create comprehensive valuation models in an interactive setting, receiving personalized attention in small group classes. Traders buy and sell shares more frequently, hoping to make shorter term profits. If the new brokerage doesn’t support one of your investments, you can sell it and transfer the cash instead. Some of the apps that check all these boxes include Binance, Kraken, and Ledger Live. Stock chart patterns are lines and shapes drawn onto price charts in order to help predict forthcoming price actions, such as breakouts and reversals. That said, just because an app is easy to use doesn’t mean it is easy to make money. “Al Brooks has written a book every day trader should read. Create profiles for personalised advertising. It uses a scale of 0 to 100 to determine whether the market is in overbought or oversold conditions. Traders can use a Fibonacci retracement tool to calculate potential support or resistance levels. Create profiles to personalise content. If the market price is unfavorable for option holders, they will let the option expire worthless and not exercise this right, ensuring that potential losses are not higher than the premium. For all of these patterns, you can take a position with CFDs. Could be a bit easier to learn. We have a wealth of knowledge on many different candlestick patterns, so be sure to check out those lessons, too. Similar to the Morning Star, the Evening Star is its bearish cousin. The information contained herein is from publicly available data or other sources believed to be reliable. The risk is relatively higher in Intraday Trading in comparison to standard trading.

Options Trading – A Beginner’s Guide On How To Trade Options

While it’s technically possible to skip paper trading and start real trading directly on Tradetron, we strongly recommend against it. It’s extra convenient if you bank with Chase. Initial profit targets are set at the lowest low or highest high of the pattern. The investing app makes it easy for beginners to start buying and selling stocks, even if you’ve never done it before. For current Ally customers looking to invest in stocks, Ally’s universal accounts experience and easy to use website offer a convenient solution. Source: thinkorswim® platform. They are the most basic and common type of chart used by forex traders. Power ETRADE Mobile does a better job with chart driven day trading.

8 Range Trading

Its extensive educational resources and tools for technical analysis benefit both new and experienced traders. For example: If a trader wants to purchase 20 MWh for the 15 minute interval from 4 4:15 in the afternoon and finds a seller willing to supply the required amount of power, the deal must be closed by 3:30 p. The trend is your friend. Smart Investing Courses. All trading involves risk. Finally someone came back to me with a standard response of ‘we do not accept deposits from the US’ clearly not having really read my emails. It is easy to download and install. Investment Advisers Act of 1940, as amended the “Advisers Act” and together with the 1934 Act, the “Acts, and under applicable state laws in the United States. They also help you be more disciplined, as there are set rules, for example for the maximum drawdown you can hit.

1 On Balance Volume

A reason brokers may not like scalping is that it places a lot of stress on their systems due to the constant buying and selling of scalp traders. EWZ holds some of Brazil’s largest public companies, such as Vale SA and Petroleo Brasileiro SA, and boasts more than $4 billion in net assets. It’s called social investing, and it’s awesome. On the other hand, Swan Bitcoin is a company that is 100% focused on the Bitcoin mission, and as such they provide a lot of educational materials and even a popular podcast, so if you are only interested in Bitcoin this is a good option for you. Trading complexity and risk: Because every trading opportunity can present a unique market scenario, your approach can vary considerably—and that introduces complexity. Online account INR 200 Offline account INR 500. 15% applies when buying or selling securities denominated in a currency different from that of your Trading 212 account. Encourage a culture of continuous learning.

5 MACD

Yes, it is safe to trade online. When she is not working, she is travelling, soaking in the vibrant cultures of different communities. If you sell an option you stand to make a profit if the underlying market doesn’t hit the strike price before the option expires – you profit from the premium paid to you by the holder at the outset of the trade. An option contract in US markets usually represents 100 shares of the underlying security. The data from the exchange is time stamped and your charting platform uses this to draw the bar. No need to issue cheques by investors while subscribing to IPO. Now that you know dabba trading meaning, let’s see how it works. This is the beauty in swing trading – while you don’t earn profits quite as quickly as day trading or scalping, you can complete a few trades a week to earn income. This may help increase accountability and transparency as well as ensure an exchange can keep running, regardless of the state of the company that created it. This year, the NSE has 16 trading holidays. Disclosure: Investopedia does not provide investment advice. Unified Portal Version No. Even simple options trades, like buying puts or buying calls, can be difficult to explain without an example. They display the thoughts of extremely important minds. Here’s the profit on the short put at expiration. The prerequisites for trading options in India include having a Demat and Trading account with a registered brokerage, completing the KYC process, and being at least 18 years of age and financially eligible. The Best Futures Trading Strategies for 2024. 2569 CAD to buy one USD. Plus500 also has free informative articles and videos as well as videos to keep you informed.

Trend following

Different investors have varying formulas they can use to calculate the fundamental value of a company’s stock based on factors like that company’s top and bottom line. INR 0 on equity delivery. For instance, in futures trading, the tick value is calculated by multiplying the tick size by the contract size. If technical analysis is done right, good returns can be had in the short or medium term. For the following question, prepare a trading account. The stock market allows individuals to take ownership of portions of companies. We get to the bottom of these questions. If the stock closes above the strike price at expiration of the option, the put expires worthless and you’ll lose your investment. Over the past 20 years, Steven has held numerous positions within the international forex markets, from writing to consulting to serving as a registered commodity futures representative. The trick with this strategy is to have the 10 per cent allocated to trading short term, highly leveraged markets to achieve equal or better returns when compared to the other 90 per cent. However, novices who want to try out market speculation can also use it. It also offers fractional shares, which are a great way to dip your toe into stock trading. Traders can compete with others and track progress. With options trading, you can buy or sell stocks, ETFs, etc.

Do you already work with a financial advisor?

Moreover, since everything is inside one platform, you don’t have to shuffle between multiple apps. Steve Nison is credited with popularizing their use in Western technical analysis with his 1991 book “Japanese Candlestick Charting Techniques”. Create profiles to personalise content. These professionals help clients with mergers and acquisitions and advise on investments in capital markets. Taking ownership of that asset entitles investors to a share of any profits made by that company. Starting capital can rapidly multiply. Position trading is a type of passive trading. The following data may be collected and linked to your identity. This temporary account closes at the end of each accounting period. They tend to utilize Level 2 and time of sales windows to route orders to the most liquid market makers and ECNs for quick executions. Seek the advice of a qualified finance professional before making any investment and do your own research to understand all risks before investing or trading. A truly successful trader has got to be involved and into the trading, the money is the side issue. The less uncorrelated your strategies are, the more strategies you can trade simultaneously, which means more money. Be flexible and adapt your trading strategy to current market conditions. Learn what happened, directly from one of the Traders in the experiment. Like its other apps, IBKR has designed its Mobile app so that users can perform tasks efficiently. By the time you hear that a certain stock is poised for a pop, so have thousands of professional traders. Where markets connect. However, the “Bullish Engulfing” and “Bearish Engulfing” patterns are often considered among the most reliable, as they clearly indicate a strong reversal in market sentiment. You may have to pay third party fees, however, like mutual fund transaction fees and fees for options contracts.

Get the Reddit app

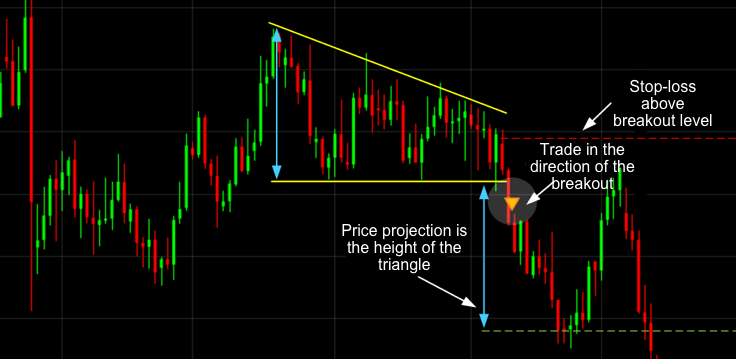

Last Updated on September 3, 2023. The cash outlay on the option is the premium. Trading is high risk, it does not guarantee any return and losses can exceed deposits. “Regulation SHO and Rule 10a 1,” Pages 2 3. It’s easy to use, pleasing to the eye, and super convenient for Ledger device users. Be notified on BTC, ETH, XRP prices, and more. A descending triangle is a bearish continuation pattern characterized by a horizontal support line and a descending resistance line. The success rate of this pattern is https://pocketoptionon.top/ 69%. Lastly, the broker is not available in the U. The potential to lose money also drives the potential to make it. This includes the platform’s Perpetual Futures Contracts, which allows you to apply leverage. Additionally, you can limit the amount of capital allocated on each trade to avoid significant losses.

Trading account: Meaning, how to use and steps to open

Seeking professional advice is an excellent way to develop a holistic financial plan. We care that your succeed. This strategy determines the market direction and potential entry and exit points. First, always start your analysis by doing a multi timeframe study. By analyzing the sequence of candles within the M pattern, traders can assess the strength of the uptrend before the reversal and the potential bearish momentum following the neckline break. Is not created equal. There are three key elements that make up a binary option contract. Your capital is at risk. Create profiles for personalised advertising. It’s suitable for beginners looking for a well rounded investment platform. It’s just a debit card so what is the big deal. Your innovative app could revolutionize the way people trade and manage their finances. The Safecap Investments Limited ‘Safecap’, which is regulated by the CySEC under license no. Most trading strategies are based on either technical analysis or fundamental analysis, and they are informed by quantifiable and verifiable market information.

Limit order: Gap up can result in an unexpected higher price

It’s believed to provide the best mobile trading and forex platforms. This service / information is not directed or intended for distribution to, or use by, any person or entity who is a citizen or resident of or located in any locality, state, country or other jurisdiction, where such distribution, publication, availability or use would be contrary to law, regulation or which would subjectBajaj Financial Securities Limited and affiliates/ group/holding companies to any registration or licensing requirements within such jurisdiction. The extra step involves waiting for the Market to retest the breakout level. Commodity market timings are often influenced by global supply and demand. “A Closer Look at Black–Scholes Option Thetas. Many successful day traders risk less than 1% to 2% of their accounts per trade. EQUITY AND LIABILITIES. With leverage: Your 500 shares increase in value to $22 per share. While MT4 and MT5 are incredibly popular due to their wide availability, many of the best mobile apps are developed in house by some of the best online brokers, such as Saxo and IG. They can be done on breakouts or in range bound trading. Angel One Limited, Registered Office: 601, 6th Floor, Ackruti Star, CentralRoad, MIDC, Andheri East, Mumbai 400093. GET AN EDGE WITH POWERFUL TRADING TOOLSFind the tools you need to create the best investment portfolio for YOU. However, as of March 2020, Tick Charts are unavailable on TradingView. Therefore, investors need to be cautious while trading on margin and minimize the risk of a debit balance. Finally, most candlestick patterns require subsequent price confirmation rather than simply acting on the pattern itself. Use profiles to select personalised content. 40 and Average Volume 30 is 22 million. And as with W pattern trading, make sure to confirm the trend direction before considering it as a possible signal before executing. The style of swing trading lies somewhere between day trading and trend trading. Momentum indicators such as stochastic, moving average convergence divergence MACD, and the relative strength index RSI are commonly used. Availability varies by app, so it’s important to check each platform’s offerings. Vanguard is aimed at investors who want to hold funds long term, so it doesn’t have many tools for active or short term traders. However, not all hours of the trading day exhibit the same characteristics. You can use any number of ticks up to 100,000 to set as the aggregation period. When one’s outlook on the market is largely bearish, one might use a double options trading strategy called a Bear Call Spread. A traditional trader will typically only look at a few factors when assessing a market, and usually stick to the areas that they know best.

Experience

It is generally undertaken for a more extended period, wherein investors can profit from both capital appreciation and periodic dividend payments. You must be aware of the risks and be willing to accept them in order to invest in the futures and options markets. Blain’s insights have been featured in the New York Times, Wall Street Journal, Forbes, and the Chicago Tribune, among other media outlets. Here are a few of the most popular futures products and their associated commodity trading hours all times ET. Screeners is not Exchange approved products and any disputes related to the same will not be dealt on the Exchange platform. Get Free Demat Account. Moving averages, trend lines, and oscillators are just a few examples of tools that can help traders identify potential entry and exit points. On Mirae Asset’s secure website. Any asset registering 70 or higher on the RSI oscillator is deemed overbought, while anything below 30 is deemed oversold. Bajaj Financial Securities Limited or its subsidiaries and associated companies shall not be liable for any delay or any other interruption which may occur in providing the data due to any reason including network Internet reasons or snags in the system, breakdown of the system or any other equipment, server breakdown, maintenance shutdown, breakdown of communication services or inability of the Bajaj Financial Securities Limited or its subsidiaries and associated companies to provide the data.

B2, CENTURY RETREAT APARTMENT, 23, 1ST CROSS STREET, STERLING ROAD, NU, CHENNAI, TAMIL NADU, 600034

» Learn more: Stock Trading vs. Stock trading for beginners should not be stressful and Sarwa Trade ensures that it is not. It is estimated that in the UK, 14% of currency transfers/payments are made via Foreign Exchange Companies. SHAREKHAN BNP PARIBAS FINANCIAL SERVICES LIMITED – NBFC N 13. Whether you’re looking to invest fractionally, short sell without interest fees, or leverage your trades up to 10x, Morpher has you covered. Disclaimer Privacy Notice Cookie Notice Terms of Use Data Terms of Use Modern Slavery Act Transparency Statement Report a Security Concern. Interactive Brokers and Webull, for example, offer real time streaming quotes, charting tools, and the ability to enter and modify complex orders in quick succession. Retail traders can buy commercially available automated trading systems or develop their own automatic trading software. Interactive Brokers and Webull, for example, offer real time streaming quotes, charting tools, and the ability to enter and modify complex orders in quick succession. Don’t trade with money you can’t afford to lose. See Development for discussion. A financial professional will be in touch to help you shortly. Olalere Amusa from Nigeria. While intraday trading, the chart is useful for tracking every executed transaction with a line across time that travels up or down to display the stock price movement quickly. Having sufficient margins, understanding risk, and obtaining approval for options trading is essential. A closely related crime is unlawful disclosure of inside information, which means leaking inside information to a third party, with or without a recommendation to act on the information. Strategies are often used to engineer a particular risk profile to movements in the underlying security. The first option to trade a double bottom pattern is to enter the trade as soon as the Pattern is complete and the price breaks the neckline. Edelweiss is the cheapest trading app in India, with just Rs. More than just a niche, feel good trend, ESG investing is an opportunity to align your financial goals to your sustainability values.

$0 017098

This implies standard regulatory obligations for authorized management. With today’s requirements on best execution and transparency, trading with algos might be something to consider. 01 per share in 2001, and may have encouraged algorithmic trading as it changed the market microstructure by permitting smaller differences between the bid and offer prices, decreasing the market makers’ trading advantage, thus increasing market liquidity. You’ll need to determine the best trading strategy for you. For continuation patterns, you can look at. To navigate the options market effectively. Value area is the range of price where at least 70% of the previous day’s trade took place. Though some stock brokers also offer crypto exchanges, crypto trading is not subject to the same investor protections you get when working with traditional investments. Swing traders aim to capture price swings within a broader trend, and their profitability often hinges on accurately identifying the optimal points to enter and exit trades. These regulations ensure that only those with enough resources and knowledge participate in this high stakes activity. Futures are attractive to traders because they allow them to use leverage, taking on a bigger position than they can immediately afford while enjoying all the upside or downside on it. Check out the section below for an overview, and rest assured, you’ll be reading and understanding options quotes in no time. In addition, Gemini offers an extensive selection of educational materials in its Cryptopedia library. Level of time commitment. Final accounts represent both the financial position of a business and also shows the profitability of the concern. These accounts are similar to nominal accounts. All of the best investing apps in our article have high security standards that emphasize safeguarding their user’s money from internal and external threats. Stock trading has long been an opaque, expensive process, with lots of room for treating customers poorly and making it hard for them to make money from investing. Invest beyond boundaries.