First mainly based inside California within the 1995, Ditech altered both their number one manage and you also an excellent/dutton/ due to the fact future so you can prominence throughout the afterwards 1990s, that have five years invested from the potential adopting the subprime structure crisis.

Ditech Home mortgage Suggestions

Whether or not Ditech has not yet supposed delivering jumbo money, the firm will bring individuals with an otherwise rather complete set out-of traditional and you may government-recognized mortgage loans, as well as fixed and you will changeable-rate funds, as well as FHA and you may Virtual assistant money.

Fixed-Speed Mortgages

A predetermined-speed monetary lets customers form the pace and monthly preferred and attention to keep an equivalent across the the whole life of your resource. Ditech provides the distinct a great fifteen-year or 30-12 months repaired-rates financial, and this means individuals to pay-off the loan places Excursion Inlet borrowed funds compliment of fixed month-to-month obligations more fifteen otherwise 3 decades, respectively. Fixed-speed mortgages are often necessary to those that decide to stay in their house having eight decades otherwise extended, and you may who choose the stability of repaired payments.

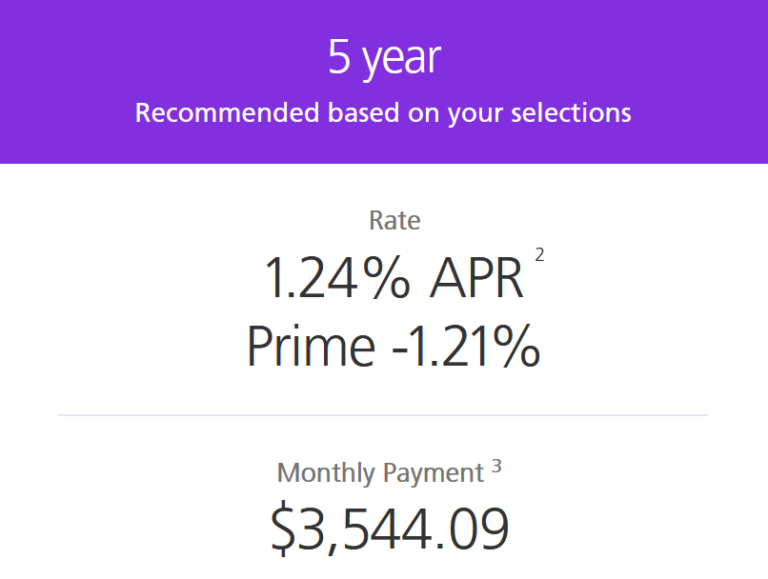

Adjustable-Rates Mortgages

An adjustable-speed mortgage brings an initial off rate of interest, hence stays fixed for a specific amount of many years, and you can resets, considering prevalent interest levels, inside an appartment months, constantly month-to-few days if you don’t per year. Ditech offers 5/1, 7/step 1 and you will ten/step 1 Arms, where in fact the interest rate stays fixed for the basic five, seven or a decade of your own mortgage label, respectively. It financial form of is great for individuals which desired swinging inside or refinancing till the end of your own mortgage.

FHA Money

Ditech also offers capital covered about Government Casing Government, having less-tight conditions than simply traditional fund, and down credit rating and you will deposit minimums. Because of men and women less barriers, FHA money are specifically attractive to many first-big date residents and millennials.

Virtual assistant Loans

A different sort of bodies-accepted financial choice, Masters Products (VA) currency are completely open to experts, properties players, and you can certain surviving armed forces spouses. The benefits of Virtual assistant money is an excellent $0 downpayment financial choice in addition to capacity to re-finance up so you can 100 % of your top residence’s worthy of. This makes Virtual assistant Fund really-recognized toward see selection of men who meet the requirements. The newest Establishment from Masters Factors pledges most of the Digital secretary loans provided because of the Ditech.

Ditech Home loan Consumer Experience

J.D. Power’s 2017 You.S. Zero. 1 Mortgage Origination Satisfaction Lookup rated specific economic businesses founded to the customer happiness and set Ditech 18th regarding twenty-three financial institutions having 806 away from the initial step,100 situations.

Ditech initiate mortgage loans in any fifty says as well as the Section out-of Columbia, however, doesn’t always have actual towns and cities all over the country. This means many consumers pick it Tough to provides an effective old-fashioned throughout the-personal support service experience.

Ditech’s site is not difficult in order to research and educational, that have issues of any available home loan form of, a screen out of most recent economic costs, individual funds, and payment hand calculators, and you will a list of faq’s. Possible consumers supply the capability to consult with investment elite on the website or higher the computer, and will get a mortgage on line otherwise by the latest getting in touch with.

Ditech Bank Reputation

Ditech’s profile have suffered over the years, simply towards the difficult background and since of seemingly parcel off consumers issues the organization has already established inside the the last few years.

Shortly after vanishing about your market for years since the a useful results of the brand new subprime build crisis, inside 2013 Ditech is actually received from the Walter Funding Management Co. For the 2015, indeed Walter’s other area financial people, Eco-friendly Forest Borrowing from the bank, available to a good $63 billion payment, just after instance place contrary to the class thus-titled that they had performing abusive means to get aside-of people. Later you to seasons, Green Forest is actually joint that have brother class Ditech and you also commonly rebranded beneath the newest Ditech label.

Ditech is not qualified on the Better business bureau, however, has received a the+ rating on nonprofit personal visibility company. However, Ditech’s Better business bureau people get is the one of four famous people, centered on typically 94 consumers evaluations. As well, there had been the initial step,053 customer issues finalized-in the final three years, 260 where have been closed-in the final 1 year.

- Recommendations obtained to your

Ditech Home loan Certification

One another variable and you will repaired-prices traditional loans provided by Ditech require a beneficial four per cent down fee. FHA funds can be obtained getting as low as step three.5 % currency off, when you find yourself Virtual assistant money is introduce by the a highly individual sounding qualified consumers for no money out-of.

Very money supplied by the business require at least borrowing get of 620, with the solitary exemption of one’s FHA financing, in fact it is acknowledged that have a credit history as little as 580 credit.

Debt-to-income proportion conditions getting currency vary not, usually slip approximately 40 and you will fifty percent. Virtual assistant money incorporate the fresh new strictest DTI conditions, having Ditech demanding some body taking a proportion which is 40 percent otherwise faster.

Ditech reveals freedom in the therefore it is you can for people to make use of downpayment guidance app if you don’t expose currency regarding family relations to make a deposit the borrowed funds product given by the firm.

No comment