When you should play with an excellent HELOC: An excellent HELOC are useful a property restoration, a giant repair perhaps not protected by your homeowner’s insurance policies, or a second house. HELOCs may also be used so you’re able to combine higher level financial obligation, otherwise release cash for the lifetime desires. If you are searching for less Apr, you might want to thought good HELOC. One other reason people have fun with good HELOC is because they wish to to help you years set up, or stay static in their house immediately after old age that may require renovations making your house safe and obtainable. A good HELOC lets these to borrow on the latest collateral they usually have attained in their house and will be offering more options for the new citizen.

When to have fun with an unsecured loan: Its fairly simple – Are you looking to cover a single-big date expense and you can know the precise matter needed seriously to reach your goal? A personal loan could work finest right here, as you are able to obtain as little as $five hundred.

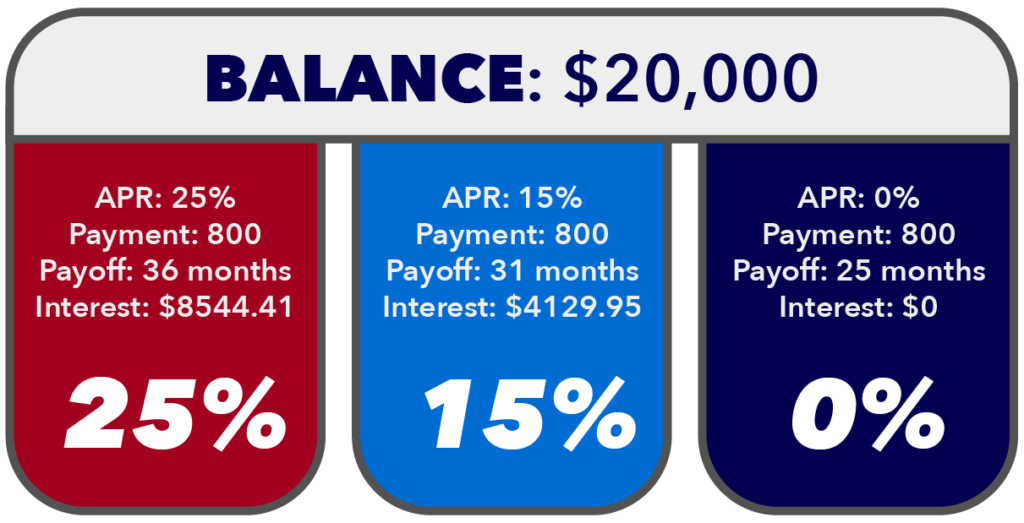

When you should play with credit cards: Playing cards with a 0% Annual percentage rate introductory bring might appeal to your, as they provide an adaptable personal line of credit in place of a good lump sum payment of cash like might located having an unsecured loan. When used responsibly, handmade cards allow you to generate profits right back otherwise perks having the items you buy every day.

Some reasons why you can decide to use an unsecured loan are merging credit debt, take a trip otherwise medical costs

Pros: With a good HELOC, you really have independency because you ount of money, but you don’t need to put it to use the. You simply use what you need in place of bringing the money immediately right after which (bummer aware!) shell out attract with the complete count. Additionally, it is likely that that have a good HELOC, it’s possible to subtract appeal when designing Internal revenue service-qualified renovations. While thinking about taking out a great HELOC, make sure you talk about taxation effects having a financial top-notch.

Cons: A great HELOC are an excellent lien on the family, very ensure you merely withdraw what you would like and can afford the cash back to quit foreclosure.

Pros: An unsecured loan my work best for those who are alot more exposure averse. As stated, he or she is personal loans, which means your family actually developed since the guarantee from the financing. You will want a different car, or surprise medical costs you will definitely pop up this is not secure by the insurance. A consumer loan is actually an expression financing, definition you only pay it right back over a period of day with fixed monthly obligations and you will a fixed rates.

Cons: Whether your credit history isn’t really somewhat right at this time, it may not enter your absolute best hobbies to get a personal bank loan because your need amount exceeds the loan limit or you are considering a premier Apr. Plus, brand new terms of the borrowed funds might be quicker than which have HELOCs, therefore you should have a shorter time to spend the bucks right back.

Together with, the rate can alter considering markets standards over installment loans online in Maryland the lifestyle of one’s mortgage

Pros: Which have a charge card, your borrow what you would like toward a rolling foundation, and you may finance appear when you need all of them. They’re much easier and you will covered by the financial institutions and you may organizations. You could earn things or kilometers. Together with, using your balance completely monthly can increase your credit score.

Cons: When you’re not able to shell out your balance in full the week, you will beginning to collect focus on delinquent equilibrium. In turn, their Apr are changeable, that it you can expect to improve. With respect to the Ny Government Set-aside, in the second one-fourth of 2023, People in the us carried $step one.03 trillion in debt. step one Which is a great amount of zeroes! With a charge card, rates are usually greater than having a good HELOC otherwise personal loan. If you’re paying down what you owe month-to-month is an excellent issue, holding a balance isnt, and certainly will eat into the budget.

No comment