Forming an LLC (limited-liability organization) for each and every leasing assets that you individual produces good team experience. LLCs promote a supplementary covering out-of courtroom safety amongst the personal and you may team possessions which help shield you from private accountability.

Real estate traders often ask if you have ways to rating a mortgage underneath the title of your LLC. The answer was sure. In fact, Roofstock can help to cure one of the biggest barriers inside the providing an enthusiastic LLC financial (and that we’re going to can later on).

Advantages of choosing an LLC getting a home loan

Inspite of the identity, a keen LLC home loan isn’t really a different type of mortgage. Instead, it identifies the method familiar with receive funding to own investment property lower than an enthusiastic LLC.

- Limited-liability and you can enhanced safety for the personal assets through the elimination of personal experience of legal actions and you can business loans and personal debt.

- Acts as a kind of accountability insurance rates from the restricting experience of a terrible-circumstances financial problem created by personal injury, commitment problems, or bankruptcy proceeding.

- Sets a corporate commission and you may credit score, which makes upcoming local rental property sales simpler that have an enthusiastic LLC mortgage.

Great things about having a keen LLC

New You.S. Business Government (SBA) notes one playing with a legal business framework instance a keen LLC helps protect yours property out-of providers-relevant debts otherwise lawsuits.

While you are in a lawsuit, the other party is only able to just be sure to hold your organization accountable as opposed to your myself. So, your personal residential property including a vehicle, house, or any other assets commonly on the line.

Limited liability businesses are not too difficult in order to create and you may check in, with a few states enabling the whole way to be achieved on the web.

- Get a hold of a business label shortly after checking with your condition Corporation Commission or Secretary out of Nation’s work environment to be sure title isn’t really already in use.

- Carry out and you will document new Articles of Business that come with your company company name, address, and labels and personal address of any LLC user.

- Create a working Agreement you to means your own organizations regulations and rules, user duties, show out-of control, and just how profits and you will losings is delivered.

- Obtain any company license or enable required by your state and you can local government, including a license accustomed collect and remit leasing tax.

Carrying local rental property around an enthusiastic LLC can cause tall taxation professionals. According to the Taxation Foundation, this new Irs treats a keen LLC because a solution-through providers not subject to a corporate tax.

So it takes away double taxation – in which payouts are taxed first from the company peak, an additional date in the individual peak. Alternatively, buyers report the newest profit or loss out of per LLC on their private income tax get back.

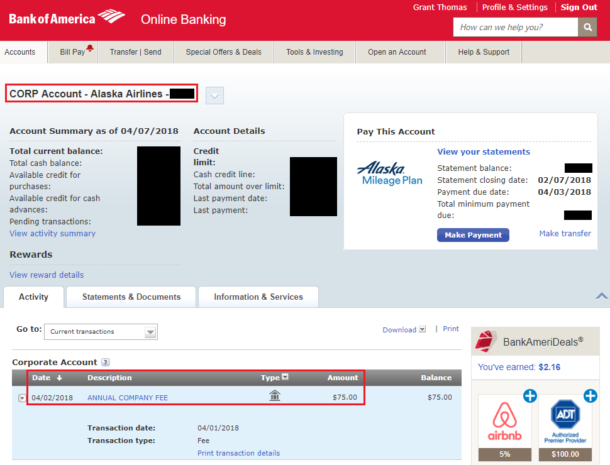

To unlock team checking and you can mastercard profile, you’ll need an enthusiastic EIN (staff member identity amount) for the LLC even although you don’t have any teams.

Which have separate bank account for your business creates a splitting wall structure involving the individual and you will providers funds, causes it to be better to monitor organization-relevant money and you will expenditures, and you may sets your business credit.

And this records does a lender need to money a mortgage lower than an LLC?

In order to get a mortgage not as much as an LLC having an effective leasing property you’ll need to demonstrate to the financial institution your running your business such as for example a bona fide team.

- Articles off Organization and you may a working Agreement for the LLC, in addition to information regarding all of the members or shareholders

- Report from Organization Payment otherwise Secretary out-of Nation’s workplace appearing their LLC is within a standing, that records was basically securely filed, and you can yearly costs are paid-in full

- Worker character number (EIN) demonstrating that the Irs recognizes the LLC to have federal taxation intentions, even if you don’t have staff

No comment