- Paystubs within the past 1 month

- W-2s for the past a couple of years

- Tax statements going back 2 years

- A couple months off bank comments

- A career offer

Assemble most of the documents one to shows there is the currency to own as frequently away from a deposit as you’re able build (20% recommended) and also the settlement costs, also a constant income to cover monthly premiums.

Getting Pre-Approved

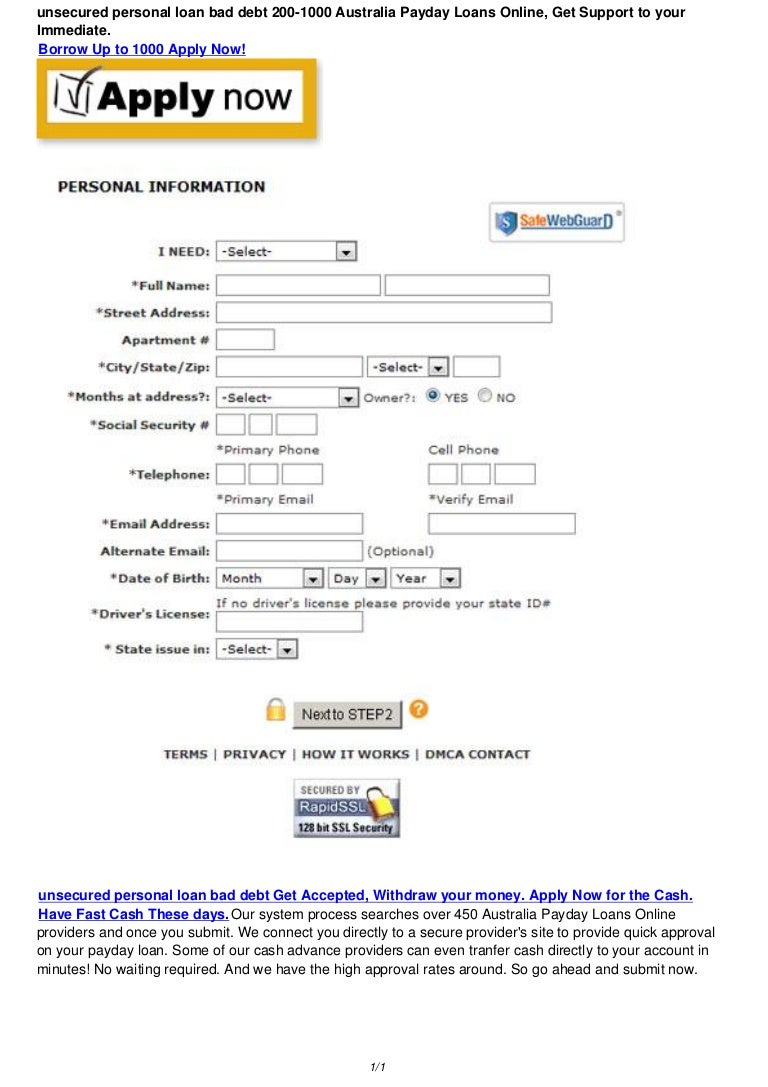

Additionally, you will offer private information, like your Public Shelter count and you may delivery go out, and you can proof of the identity together with your driver’s license otherwise county ID.

A keen underwriter usually review your own files and see if you’re eligible. The brand new pre-acceptance relates just to your qualifying affairs and additionally be contingent on possessions acceptance once you select property.

If they accept you directly on the financing, they’re going to create an excellent pre-approval page. You are able to so it letter whenever placing even offers into the houses, as most vendors won’t deal with a deal away from a purchaser unless capable confirm he has got funding.

Confirmation regarding Locked Pricing

Shortly after finding property and signing an earnings deal, it is vital to lock your own rates. You can not personal the loan as opposed to securing the pace, also it brings comfort once you understand you’ve got the rates you can afford.

Wells Fargo also offers some other secure episodes, therefore speak to your financing officer about precisely how enough time so you can secure they, offered your asked closure big date.

Medical practitioner Mortgage Solutions

Due to the fact Wells Fargo’s medical practitioner financing isn’t really a genuine physician mortgage, you could want to consider other options, for instance the pursuing the:

FHA Money

FHA funds are regulators-recognized financing to invest in an initial household. They might works if for example the domestic we want to buy is actually about how to are now living in which will be inside the financing constraints. Extremely components has an enthusiastic FHA mortgage limit from $726,200, but you will find lower-pricing and you will highest-cost portion you to alter the limits out-of $472,030 so you’re able to $step one,089,3 hundred.

FHA loans require only an excellent step 3.5% down-payment, however you will pay home loan insurance rates providing you feel the financing. FHA funds also provide so much more versatile underwriting requirements, along with credit scores only 580 and you may obligations-to-money ratios doing fifty% from the FHA be sure.

Although not, FHA funds are merely eligible for no. 1 houses. Ergo, you can not utilize them for another otherwise funding household, along with your loan constraints is straight down according to the county you get a house for the.

Va Finance

Va financing don’t need a deposit, regardless of how far your borrow, also in case your loan amount is higher than the standard loan constraints.

Virtual assistant financing feel the ensure of your own Virtual assistant, thus loan providers could possibly offer more versatile direction. Like, you could get acknowledged to have a great Virtual assistant financing that have good 620+ credit history, no advance payment, and a loans-to-money ratio as high as 43% 50%. An important try demonstrating you can afford brand new monthly premiums.

The brand new Virtual assistant demands loan providers loans Cotopaxi to a target a good borrower’s throwaway money or the money you really have leftover right after paying your expenses. This permits these to lay shorter emphasis on credit scores and you can debt-to-earnings ratios, knowing that they are able to spend the money for mortgage.

The best thing about Va loans is because they dont fees home loan insurance policies. Individuals pay an upfront but you to-date investment payment; there isn’t monthly mortgage insurance rates.

A great 20% Down payment

For many who only have to use below the standard loan limits ($726,two hundred in most section) and now have 20% to put down, you could be eligible for a traditional financing. These Federal national mortgage association and you will Freddie Mac-backed finance give aggressive prices and you may terminology, to make capital easy.

No comment