Understanding the household guarantee financing assessment process makes it possible to generate advised conclusion and ensure that you will get the finest terms on your loan.

Change to another location article section: Understanding the domestic guarantee loan assessment techniques is just one action in enabling property equity financing. Within the next part, we are going to discuss the different varieties of domestic guarantee funds and you can how to pick one that is right for you.

Domestic Equity Loan Appraisal Resources

A home guarantee mortgage appraisal try an important step-in the latest home collateral financing techniques, because determines the value of your property as well as the amount of money you could potentially acquire. To be sure a successful appraisal, listed below are four information:

Suggestion step one: Prepare your domestic. Declutter your property, make any required repairs, and you will gather one related documentation regarding impossible New Mexico installment loans your domestic, such proof renovations or improvements. A properly-managed home have a tendency to appraise getting a higher well worth.

Suggestion 2: Favor a professional appraiser. Look for an enthusiastic appraiser who’s authorized or authoritative and has experience with household guarantee financing. An experienced appraiser gives an accurate and you may unbiased analysis off your own residence’s really worth.

Suggestion step three: Be there into the appraisal. Whenever possible, be there on the assessment so that you can answer any issues the latest appraiser have. This helps make sure the appraiser keeps a complete comprehension of your house and its particular keeps.

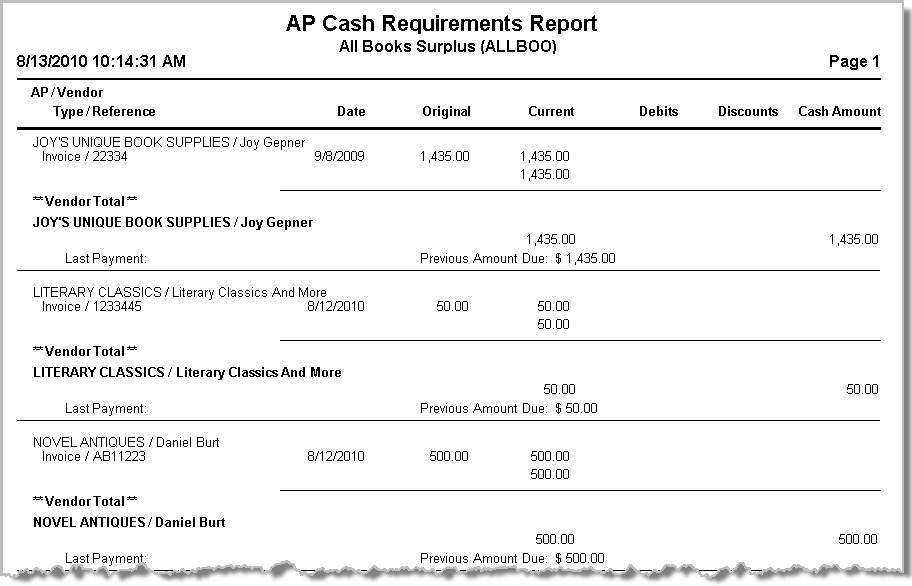

Tip cuatro: Understand the assessment statement. As assessment is finished, you will found an appraisal statement. That it declaration tend to detail new appraiser’s findings and the projected worth of your house. Opinion this new declaration very carefully and get brand new appraiser questions you may have.

Tip 5: Focus the latest assessment if necessary. If you were to think that the assessment try incorrect, you might appeal the fresh new assessment. The newest assessment notice process differs from bank in order to bank, so make sure you get hold of your financial to learn more.

By using this advice, you could increase the probability of providing a good and exact house security financing assessment. This will help you to get the really money you are able to away of your property equity loan and avoid any unforeseen unexpected situations.

Completion: A house security financing assessment is a crucial part of family guarantee financing techniques. By following these tips, you might make sure your assessment try particular and that you get the best you can terminology in your loan.

Conclusion

A property guarantee financing appraisal was a serious element of securing a home equity financing, installing the value of your home and choosing the mortgage matter and you may interest. The appraisal report will bring rewarding expertise in the house’s really worth, which you can use a variety of economic believe aim. Because of the knowing the appraisal processes and you may after the best practices, you could ensure an accurate analysis of one’s home’s really worth and you may make told conclusion about your house security loan.

Given that housing industry will continue to evolve, home security finance are an important tool to possess home owners seeking control their property’s worth to have financial gain. By meticulously because of the things you to determine home collateral loan appraisals, such markets requirements, comparable functions, plus residence’s condition, you could potentially maximize the newest equity you have access to and you can secure beneficial mortgage terms and conditions. Contemplate, a property equity financing appraisal is a vital step-in unlocking your house’s financial prospective and having debt goals.

Appraiser

- Dimensions and you can updates: The shape and you may position from similar land also are keys to look at. Land that are larger and also in most useful condition usually typically promote for over smaller home trying to find solutions.

- Facet cuatro: Loan amount ImpactThe amount borrowed you are accepted to own usually feeling the latest monthly payments on your own household security financing. A higher amount borrowed can lead to large monthly premiums. It’s important to reason behind the brand new monthly installments with regards to the borrowed funds count we should borrow.

- Factors 4: Interaction that have LenderBorrowers is keep in touch with its bank about appraisal processes. This will help make sure that people are on a single web page which the fresh assessment processes is performed since efficiently and you may efficiently that you can.

If for example the appraisal is available in less than you expected, you are able to focus the latest assessment or discuss with the lending company for a lower loan amount.

No comment