You might be the full-fledged homeowner and enjoy the reassurance which comes away from that have a destination to name their. Becoming mortgage-free is probable their destination, however they are your using the ideal station?

Possibly you have in mind an alternative mortgage you to definitely most readily useful serves your own financial requires and you can wants along the way. Refinancing your property tends to be just the rejuvenate you are looking for. This article helps you determine whether refinancing is right getting you.

- Rates is all the way down now than just once you grabbed out your mortgage.

- Switching life items has actually inspired simply how much you can pay monthly.

- You want to change to a predetermined-price financial out of an adjustable-price financial (ARM).

- You may have most other costs we need to move with the another mortgage so you can clarify repayments and you can rescue.

- Personal financial insurance coverage (PMI) no further is practical to you personally, and you also want to shed they.

These are some of the the explanation why to take on refinancing your home. But before you decide to go ahead which have refinancing, ensure you understand how it works and exactly how it will apply at your bank account.

Straight down Attract

If the rates of interest features fallen because you grabbed your mortgage, you could safer a reduced rate of interest on your debt of the refinancing. You may be considered to refinance at a lower life expectancy rate if you have improved your credit rating. Based on your loan’s course, you might save a hefty contribution with a reduced rate.

Lower Costs

If you would like extra space on your finances, refinancing could help strategy down monthly payments with a better rate of interest or a lengthier mortgage. A longer repayment period usually means that using so much more full, very consider this to be and you may work on a lender which helps you understand the choices.

Quicker Identity

Changing the expression of your mortgage is an effective refinancing alternative to you and help you save towards the attention based the specific situation. But not, a shorter identity you can expect to imply increasing your own payment, so be sure to totally understand the feeling toward budget.

Income tax Benefits

Sometimes, refinancing could save you cash on taxation. Like, for individuals who switch out of a thirty-12 months so you’re able to a fifteen-12 months financial, it is possible to qualify for a high mortgage attention deduction plus their high interest. Demand a taxation top-notch knowing exactly how refinancing often affect your own taxes.

Debt consolidating

When you yourself have several costs, specifically of them with large appeal, refinancing your mortgage may help of the merging loans. Debt consolidating form merging several debts toward one to into the lower you are able to focus, decreasing the quantity of repayments you might be juggling and possibly helping you save currency.

Fixed Interest rate

You can key out of a supply to help you a fixed-rate financial once you refinance. Altering is perfect whenever prices is lower and secure your own rate of interest into cover your self when they rise once more. Repairing your interest also helps along with your costs and you may financial considered since your financing prices are more predictable.

Security Accessibility

If you were dealing with your original financial for a while, your house equity – how much is already your personal as opposed to the bank’s – provides probably grown up. You earn guarantee once you generate costs that reduce your financial obligation, the home’s worthy of expands or one another.

If you have an unexpected financial you prefer otherwise need certainly to invest home based advancements, you might cash-out the that it collateral once you re-finance. Cashing away equity often actually leaves you with more financial obligation to settle, very workout the latest numbers which have a reliable bank just before doing it.

Losing Private Home loan Insurance rates

Should your first advance payment are lower than 20% of residence’s value during the time, you truly was required to pull out PMI. If the collateral at your home has grown earlier 20% of the newest worth or if you have enough more funds so you can contribute, you might miss PMI together with your this new loan and relieve your own monthly payments. Understand that you could request to decrease PMI in the place of refinancing if you really have adequate equity, so this is constantly one more work with as opposed to an explanation to help you refinance.

With the potential gurus, you will be in a situation in which refinancing your home is a good idea. Yet not, it is important to consider all implications and then make the best decision. Refinancing comes to can cost you that you ought to harmony facing its pros. Here is what you must know before refinancing:

- Closing costs: Also the sum you obtain as well as the interest, you additionally pay a charge to shut a mortgage. When you refinance, you only pay closing costs once again. You could potentially end these types of using zero-cost refinancing. However, that always moves the can cost you to your obligations, so you still have the other pricing.

- Credit rating: Refinancing calls for a difficult credit assessment to see if you are able to afford new conditions. It glance at may cause a temporary lose on your own credit rating. Consider enhancing your credit rating prior to refinancing for optimum interest and you will offset any hit on credit score assessment.

- Income tax implications: For those who secure a lesser interest rate courtesy refinancing, your financial interest deduction count can be smaller. Cashing aside some of your security private fool around with may also perception your own taxes. Demand an expert understand the brand new income tax implications of your own refinancing agreements.

- Prepayment penalties: Specific financial arrangements were a penalty for individuals who spend the loan before it is owed. Refinancing can be cause so it condition, thus look at your latest mortgage terminology and you may cause of people punishment.

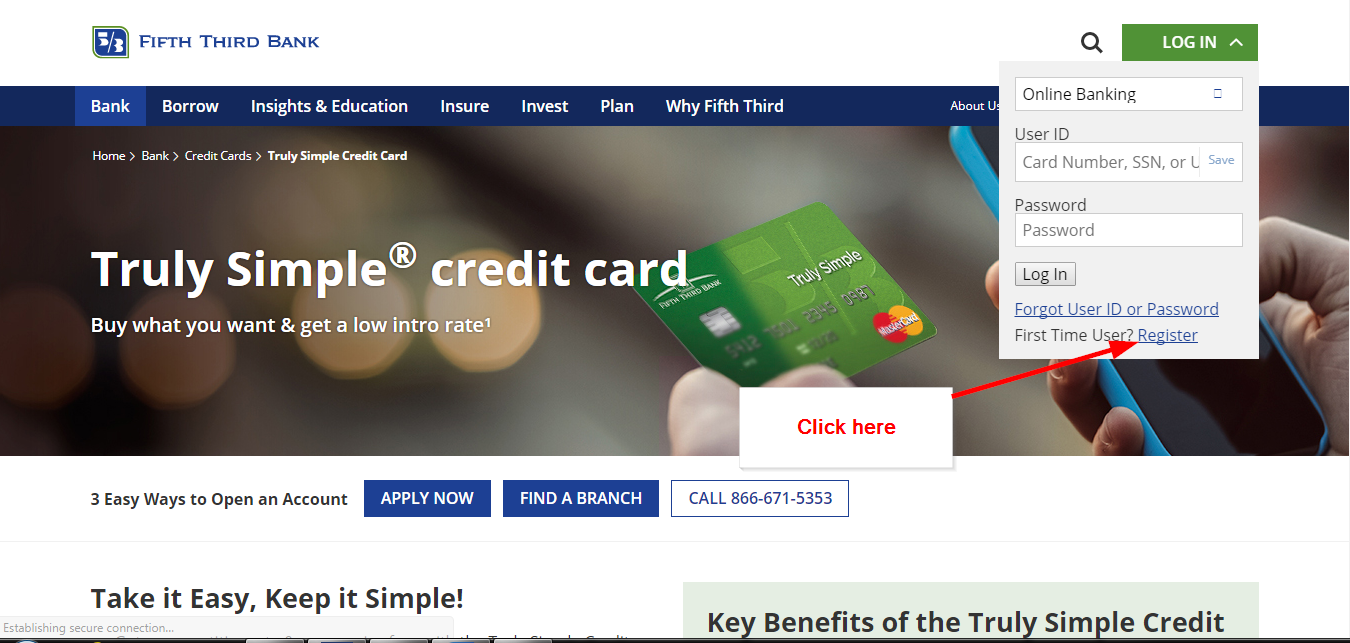

The best way to determine if you are getting an educated offer on your financial is to talk about your refinancing possibilities. Initially Commonwealth Financial, you can expect elite recommendations to help you find whether or not refinancing is actually effectively for you. If you decide to refinance, our refinancing solution brings a custom plan to meet your needs and you will reach your desires. You might re-finance your property using all of our straightforward online process.

In the beginning Commonwealth Bank, we provide as much as 99% funding with no financial insurance rates needed. And, after you sign up for refinancing, you get access to totally free homeownership counseling categories to generate payday loan Whiskey Creek an educated choice prior to closing your financial.

No comment