Rating a monetary adviser to your benefit.

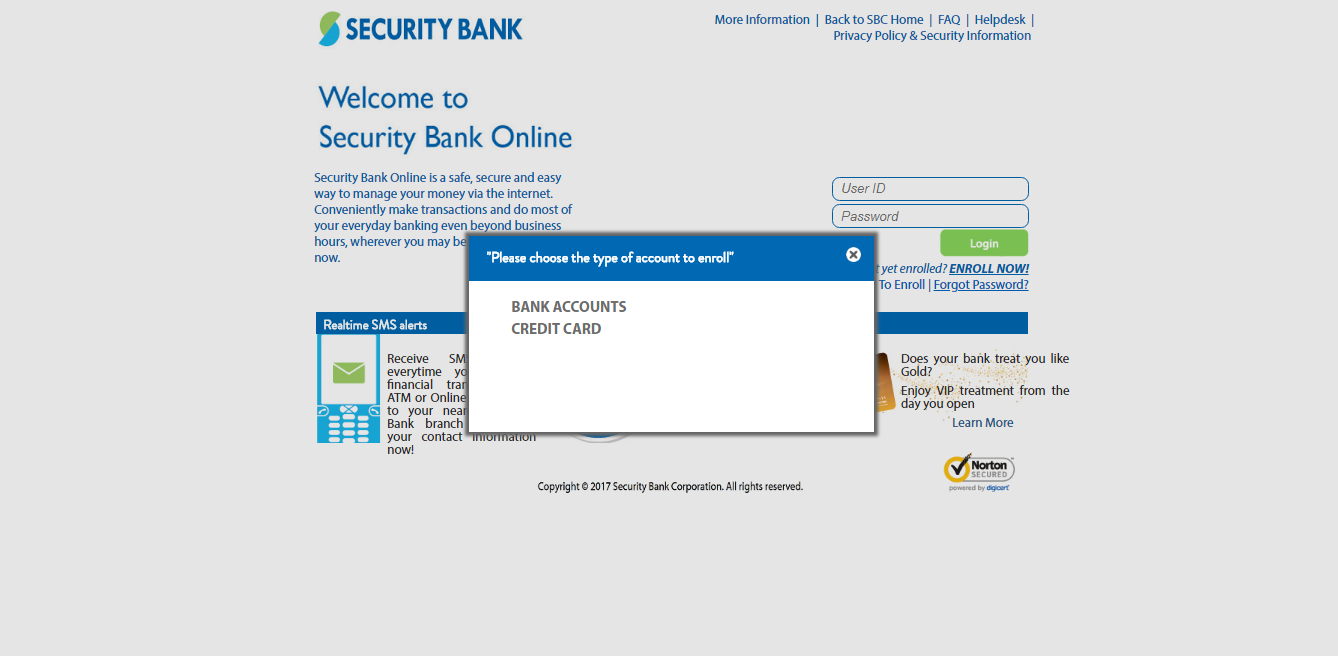

Its better to browse the fresh new Zealand mortgage landscape when you have got a monetary adviser helping you with each other. Thanks to all of us you can buy connected to a qualified mortgage adviser. Here is why it’s good notion:

Advisors is actually reduced from the lenders, so its provider to you is free You can save day, while the studies are done for your You may get a great greatest contract than financial institutions was ads Mortgage pre-recognition is easier with an agent to aid Advice for financing structuring helps to spend less interest You’ll get advice about all the files and administrator

Why would I use an agent?

Advisers are paid off of the lenders, very the service for your requirements is free All of the home loan scientific studies are completed for you You can aquire a far greater contract than the banks is actually ads Mortgage pre-recognition is easier which have an agent to assist Advice about loan structuring helps shell out faster desire You’re going to get advice about all papers and you will administrator

Precisely what does a large financial company perform?

Taking home financing is a huge price. In which might you visit find a very good lender for your things? Exactly what criteria would you have to

Exactly who will pay a mortgage broker?

With regards to opting for a large financial company or home loan agent, there are quite a few what things to check out and you may cautiously envision. This information

Are a large financial company most in your favor?

You might have read there can be constantly totally free to make use of a mortgage representative (financial agent). This is because these are typically paid back a percentage from the lender your end

Frequently asked questions.

Zero. We offer you with advice from the mortgage loans and your prospective feature to cover one to. We really do not same day loans Briggsdale program your loan otherwise offer financial advice about just what financial to use, just how to structure that loan to fulfill your specific need otherwise the risks out of borrowing the total amount you want to. Yet not, we are able to connect you to definitely a professional home loan agent that will advice about the items.

An effective mortgage broker should be aware of all loan providers, rates of interest and you can small print. They can help you to pick and that financial sales would be the most appropriate to you personally and your factors.

Changes was ongoing, thus every now and then you ought to review their home loan agreements to see if there clearly was a better package heading. It may imply changing lenders or reorganizing the loan together with your existing lender.

Zero. We provide your with information in the mortgage loans along with your prospective function to cover the you to definitely. We do not program your loan otherwise present economic advice about exactly what financial to use, how exactly to framework financing meet up with your unique requires otherwise the risks from borrowing the quantity we should. Yet not, we could link you to a specialist mortgage adviser who’ll help with things.

An effective mortgage broker should become aware of all of the loan providers, interest rates and you will terms and conditions. They could help you to select which mortgage sales might possibly be the most appropriate for your requirements plus things.

Changes is ongoing, thus time to time you really need to review the financial preparations to see if discover a far greater contract supposed. It could mean modifying lenders or reorganizing your loan together with your established bank.

An excellent revolving borrowing from the bank mortgage is like a the majority of-in-you to definitely savings account which have a large overdraft facility. You could mark down financing, lay money in and take it out once you particularly, offered you do not exceed your own limit.

An offset financial enables you to use-money an additional membership (savings otherwise informal) to attenuate the balance of one’s financial with respect to figuring the eye charged. The bucks lives in a unique account that is readily available because the typical.

An interest-merely mortgage form their typical weekly, fortnightly otherwise monthly installments merely are the focus energized. So that you don’t pay some of the currency you borrowed from (known as the dominating) until the end.

No comment