We believe that home financing re-finance can be found to lower your payment-while this is a famous reasoning to help you refinance whenever rates of interest miss below your local area already in the, typically the most popular reasoning so you can refinance is largely to save cash of the consolidating obligations. Including-if you have credit card debt you to definitely grows month-to-month at an effective 15-30% interest, but have security of your home, you can often refinance to track down cash out to expend down your own higher attention loans, for this reason leaving you with additional currency left every month.

What is actually a debt negotiation Refinance?

Home financing refinance is when you have made an alternate mortgage loan for your home, generally with a diminished speed, a smaller title, or both. A debt negotiation otherwise bucks-out refinance, although not, occurs when you refinance your own home loan for more than your existing harmony and you can borrow secured on the new collateral of your home to find cash out. You can then have fun with that money to pay off other, large appeal expense like credit cards, medical expenses, student loans, otherwise anything. Essentially your transfer your high appeal debt in the home loan.

Why does Debt consolidating Performs?

Understand exactly how this functions, we should loans Sheridan Lake CO instead talk about security. Guarantee is the difference in what you owe on your own home loan and how much your house will probably be worth. Thus, whenever home prices rise, anyone generally gain security in their house. A debt negotiation re-finance or a profit-out refinance allows you to utilize their earned guarantee to help you availability bucks and you may pay off personal debt.

Is an excellent hypothetical condition: you bought property getting $200,000 that have a good $180,000 mortgage. 5 years solution, now you borrowed from $160,000 to your mortgage. Our home also offers preferred and is worthy of $300,000, so you hypothetically keeps $140,000 for the security. Extremely lenders allows you to access around on 80% of this collateral, with regards to the specific situation of the borrower. Once you re-finance to help you consolidate financial obligation, the newest equity can be used to repay most other costs, or it could be delivered as dollars for you to spend some how you’d like.

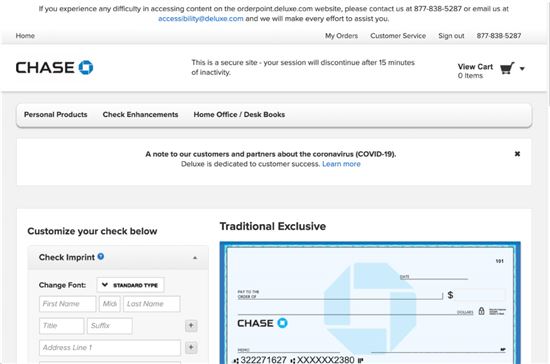

You are going to virtually discover a seek extent you choose to carry out of your own security. The amount available to acquire depends on the situation from for every single borrower.

What’s an effective Re-finance to settle Loans that have Domestic Security?

Just like the most recent mortgage pricing are repaired and have been trending around 5-7%, mortgages are one of the cheapest an effective way to borrow funds. Paying down your credit card debt who may have 18-29% interest can save you way too much money and minimize their expense. Simultaneously, home loan loans is actually covered, as well as your fee may be the exact same over time while a beneficial bank card statement is version and ingredients depending on how far you decide to spend each month.

This will cut home owners money if you are paying straight down attract with the month-to-month homeloan payment plus expenses with a high desire. By paying of your highest-focus unsecured debt which have one to, down attract mortgage, paying off personal debt can be more reasonable and you may in balance.

It’s important to remember that this does not create your financial obligation disappear. Youre nonetheless spending it off, right at a much lower interest of 5-7% in place of an everyday credit card price anywhere between 18-35%. This can help you save money and you may alter your monthly cashflow by detatching way too much expenses. A separate cheer is that home loan attract is normally tax-allowable but almost every other unsecured debt is not.* Although this refinance option is perhaps not intended to be an escape from debt dilemmas, it could be a win-winnings problem whenever used as an element of an accountable decide to control your earnings.

Where Do I have an earnings-Out Re-finance to repay Financial obligation?

Although lenders is going to do a debt consolidation re-finance, Treadstone Money provides a long track record of dealing with property owners (and their funds) to help you activity the best option to you. Treadstone’s Loan Officials commonly bank tellers. They have been lifestyle-enough time home loan gurus!

If you believe a debt consolidation refinance could help, contact one of the Financing Officials otherwise get a loan with our team today!

No comment