To acquire a property try a giant carrying out for any family members, but it can be extremely daunting if you’re one parent. If you’re frightened that there’s no body more in order to bounce records away from off, research communities, otherwise determine a funds, keep in mind that there are numerous form somebody and you will features away there in order to navigate the feel because a first-time homebuyer.

This short article look at the benefits and drawbacks of getting against. leasing to help you influence – just like the one moms and dad – if taking the plunge can be helpful individually to date. But earliest, let’s touch on money.

Extracting the budget

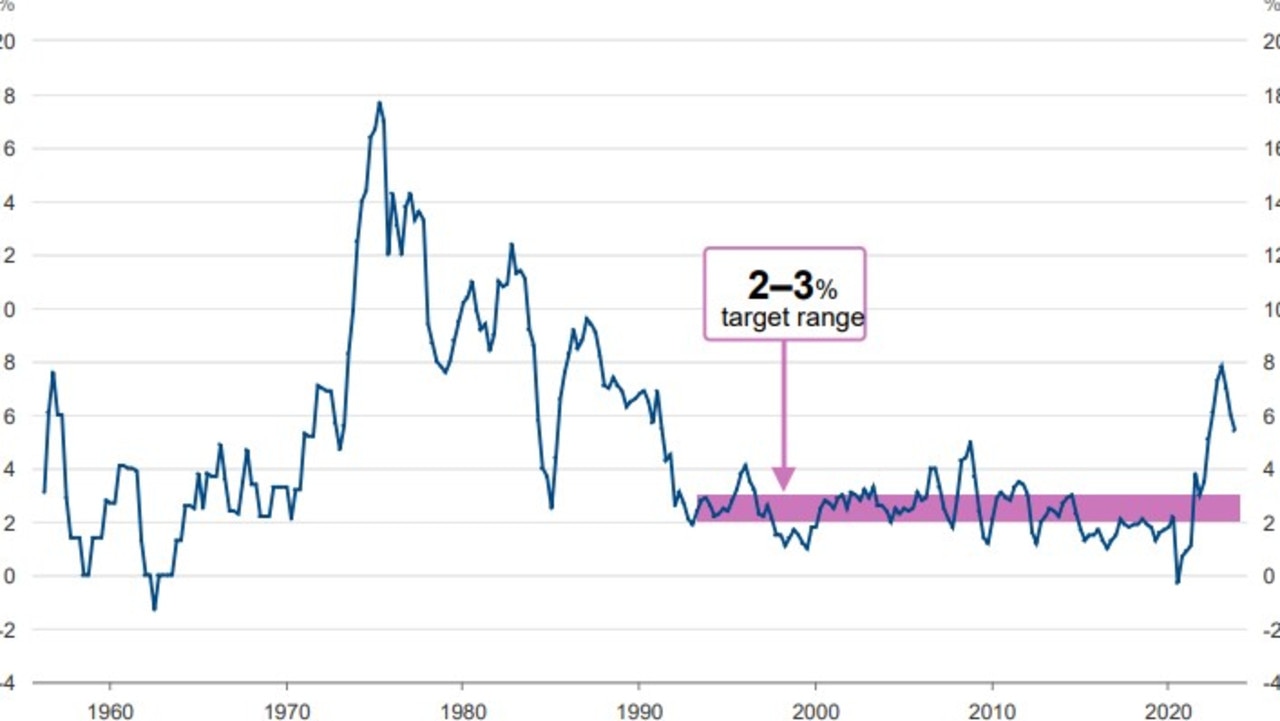

If you’re possible homeowners bother about a little rise in financial rates, its smart to keep in mind you to definitely fifteen% rates were important back in early eighties. Pricing haven’t been a lot more than 5% just like the 2010, and you can, a year ago, the average rate of interest was just 2.79%. So even in the event cost rise, they’re not predicted to go more than 4% in the 2022. That means homebuyers and homeowners remain looking pricing that make also the current large home prices reasonable.

Don’t forget that just as home prices have risen since pandemic come, rents enjoys grown, as well. Here are some the mortgage calculator to estimate the monthly installments for an assessment. After that consult a loan officer who can search in the earnings to simply help create a personalized homebuying finances to use just like the helpful information.

Great things about getting a homeowner

Continue leasing and you’re subject to a property manager who you will improve lease, evict you otherwise sell the structure downright. But when you buy a house which have a fixed-rate home loan, your monthly premiums remain a similar month just after day, time after time. One surface makes it possible to plan and rescue with other expenditures down the road. Yes, you may be taking on most construction can cost you, such as fees and you will insurance policies, but those people ought not to changes one to significantly through the years.

Considering a current Government Set-aside data, into the 2019, You.S. residents got a median internet value of $255,000, whenever you are renters was indeed at only fast 800 dollar loan $6,three hundred. That’s good 40X distinction! Its clear one to homeownership is amongst the how do i build wide range. As your household appreciates and also you reduce the borrowed funds, your build collateral on the property, something masters call forced deals.

A different advantage of homeownership arises from taxes. For people who itemize your annual write-offs, you might be capable also lower your taxable earnings by the whatever you may be paying for possessions taxation, mortgage appeal and you may – both – home loan insurance. Remember to speak so you’re able to an income tax expert before applying for home financing only to your possible income tax credits – these are typically other in almost any county.

Clients usually aren’t allowed to make changes on the apartments. Particular are not even permitted to color. By using it on you to ultimately wade Do-it-yourself, it will probably most likely come out of the pocket, perhaps not brand new landlords. But because the a resident, you are free to customize their room by any means your sweat collateral otherwise finances enables. And, while a pet owner, you have the freedom to let the furry spouse live with you as opposed to requesting consent!

The experience-good great things about providing involved in your local area is something one residents and you will clients usually takes part when you look at the similarly. However, it is true you to clients – specifically more youthful renters – are more likely to move from time to time over 10 otherwise 15 years than people have a tendency to. That is why it name to order property placing down origins.

When you’re elevating a family given that one father or mother, college region quality is a significant a portion of the where should i real time decision. It is good having kids getting a constant area with university chums that they may grow up that have – they are placing down sources, as well! Very, it is vital to keep an eye on the institution area you are able to live inside the. Select those people that are very well financed, safe and provides a number of additional-curricular situations to take the pressure from you as a best way to obtain oversight. And, you get the opportunity to make much time-long-term friendships into mothers of your own kid’s class mates.

Benefits associated with getting a tenant

When you find yourself to order property is considered a good investment, there is no verify you’ll see an income afterwards. Yes, paying off the borrowed funds and checking up on domestic repair generates domestic collateral, however, there are a lot of circumstances that will be off your own handle. What’ll the new economy be like once you wear it this new industry? Have a tendency to your personal getting among the many virginia homes at that day? Did a playground otherwise a parking area score mainly based near your own domestic? All of these could affect your selling price, creating your the home of lose inside really worth when it’s for you personally to promote. Tenants lack which more than their thoughts.

When you find yourself a resident, you will want to save and you may cover family repairs that are destined to happens sooner or later. Getting renters, it is another person’s situation. Regarding the costs plus the challenge out of employing anyone to take care of solutions in your apartment, that’s the landlord’s horror.

Owning a home must not prevent you from switching jobs otherwise moving to a different town, however it is less simple as merely breaking their rent and you may discussing the fallout. Maybe you may be a tenant who would like the option of being able to modify things right up if neighbors rating as well loud and/or travel becomes as well longpared to property owners, clients usually can work much faster when designing a shift.

Clients, from the definition, spend monthly rent. And several of those have to cough up to own cable, resources and you can – if they are smart – renters insurance coverage. Concurrently, people spend financial dominating and you can attention, assets fees, homeowner’s insurance rates, often financial insurance coverage, typical repairs, safety features and all of the fresh resources mentioned above after which some. There are also homeowner’s association (HOA) fees to have condos otherwise gated organizations. Thus while you are there are many different benefits to to buy a house, home owners commonly generate even more monitors than renters would.

Willing to proceed?

Given that an individual mother, your ily’s only breadwinner, however, choosing whether or not to get otherwise book is not a simply financial decision. Discover psychological things which go in it too. If you would like let consider the benefits and you will downsides, dont think twice to touch base.

Movement Financial can be acquired to enjoy and cost people, and you may we had want to help you know if purchasing is the correct flow to you personally and you can, if so, what you can manage. To get going, see that loan manager in the region you and your folks need to call house!

Mitch Mitchell was a self-employed factor to help you Movement’s marketing agencies. The guy and produces on technical, on the web defense, the digital education people, take a trip, and you will managing animals. He would want to alive someplace warm.

No comment