Just how to Money Your own Lightweight Household

Financial support is yet another one of the biggest issues expected when looking to get a tiny home. Without a doubt, discover constantly exclusions to each laws however, some tips about what here is to be real whenever using our subscribers.

Need to know for individuals who are eligible to investment to own a small house? Click on this link to take a simple 5 matter investigations. Go into your details and you’ll be brought to the latest comparison webpage.

The biggest differences in ways to get financial support depends towards if you’re planning to construct your property or if you want to to employ a builder. We talk about just what both instances looks eg to you personally.

Strengthening your own tiny home with your dos hand is actually the lowest priced route to take. You may also get investments accomplish some of the most essential really works, however your content will be your largest prices.

When you find yourself building their smaller house just in case your take a lowered prevent funds, less than $65, Normally otherwise below $45, USD it is important to that you’re sourcing the best content and you may strengthening correctly. Whenever you are to buy property and find that for cheap as compared to wide variety that are in the list above, delight be certain that you’re doing all your due diligence. It is likely that the home may not be certified, will be unable getting legitimately towed all over provincial or state borders, may not be able to ensure they and odds are when the its mainly based by the a creator, he has got extremely undervalued what they are offering as well as their big date. In this situation, it’s likely this new builder may not be around for enough time to help with you or people service and you may promise problems that occur whenever residing a newly based family.

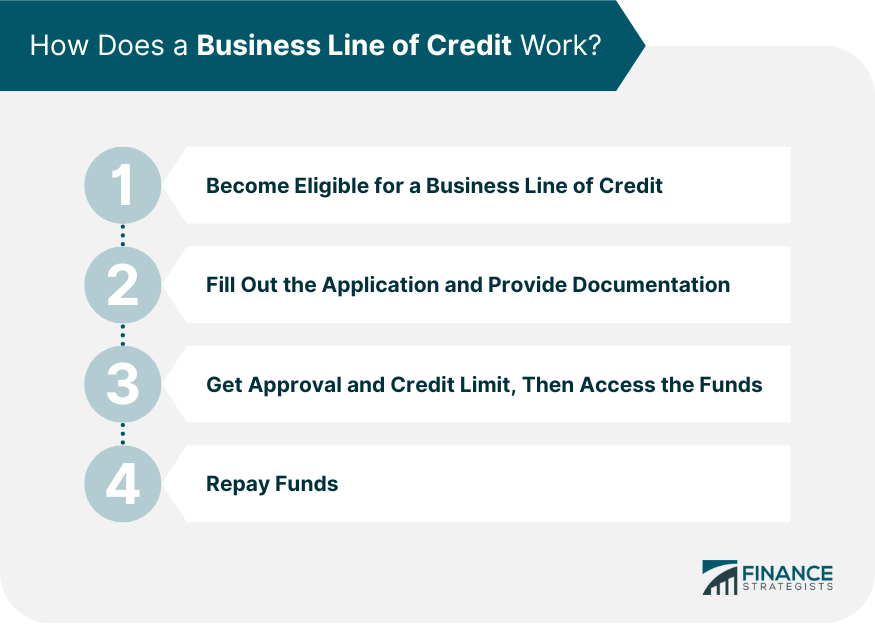

When you find yourself building on your own it is likely that you will have to wade rating a personal bank loan for the building information. This may include things such as a personal line of credit otherwise playing cards.

If you’re looking to construct a little home towards the rims having a builder, there’s an increased threat of taking an enthusiastic Rv financing to own your own small. Creditors usually generally speaking come across RVIA or CSA Rv otherwise Playground Design degree of these stimulates.

Red-flag: If for example the financial associate thinks they’re able to strategy a classic home loan to have a small house towards the wheels this is completely wrong. It is rather impractical you to definitely a mortgage could be an alternative just like the house is perhaps not forever connected to the floor. Traditional mortgages just apply at homes which might be repaired with the land.

Foundation Series Little Domestic: The origin Collection smaller house is actually home that are In a position-To-Flow concept and formal inside Canada to CSA A277 guidance. This should signify our home was strung on-site to your an excellent base and hooked up so you’re able to area characteristics. In this case, you happen to be eligible for a good chattel home loan, similar to that of a mobile or are formulated household. Here are some a whole lot more from the right here to your Foundation Collection:

The fundamental guidelines of getting money:

For those who have poor credit, no money, zero proof of money, with no coupons, it is extremely unrealistic anybody is going to finance both you and leave you money. Discover financial support one must have a good credit score, a downpayment, and proof money you are in a position to pay right back the fresh new lent money. Wish to know for folks who are entitled to resource for a tiny family? View here for taking a fast 5 question testing loans Coffee Springs.

No comment