- You get a two-to-four-device property and you will live-in you to definitely tool

- There isn’t any down payment requirements

- Since , there’s absolutely no restriction regarding how far Virtual assistant-qualified consumers normally acquire that have zero down

The brand new zero-down Va mortgage to have money spent is an excellent work for getting people that make the most of they. You should use leasing earnings out of your tenants to pay for area otherwise all mortgage payment and create wide range.

How come the Va home loan having investment property functions?

You earn an excellent Virtual assistant financial for investment property the same way you’d get a good Va mortgage getting a single-friends household. You’d meet the requirements according to your income and credit score.

But not, should you want to rating borrowing from the bank toward prospective rental earnings on assets, the lender must verify that you’ve got some property owner, assets administration or relevant feel and that you enjoys discounts so you’re able to coverage your mortgage payment even if the units go unrented to own 6 months. With regards to the Virtual assistant, loan providers need to make certain:

- Cash reserves totaling at least six months mortgage repayments (prominent, notice, fees, and you can insurance – PITI), and

- Files of one’s applicant’s earlier feel dealing with local rental gadgets or other history associated with both possessions repair and you can local rental.

https://paydayloanalabama.com/goodwater/

In the event the Virtual assistant financial establishes that you have enough discounts and the newest reasonable probability of triumph once the a property owner, it allows you to definitely matter current or prospective leasing earnings to help you counterbalance the mortgage repayment.

Figuring your qualifying local rental money

You don’t get so you can matter all the leasing money whenever qualifying to own a great Va financial. Underwriters look at the latest rentals toward property and invite 75 per cent of one’s book throughout the products you’ll not inhabit on your own. Whether your possessions does not have clients, the lender lets 75 percent out-of an appraiser’s advice of one’s reasonable local rental really worth toward units.

Va underwriting assistance suggest that, A portion greater than 75 per cent may be used if for example the reason for including percentage try acceptably documented.

The way it actually works

During that composing, there was a good step three,700 sqft duplex within the Vegas, NV which have sales cost of $315,000. Another tool brings $step 1,eight hundred 1 month when you look at the rental money.

Think that you devote zero off and you will money $315,000 and additionally an effective $six,772 Virtual assistant Funding Percentage. Their total payment per month, and taxation and home insurance, would-be from the $2,000 which have good cuatro.5 % home loan price.

If not matter the local rental money to your home loan certification and have now not any other debts, you would need qualifying money away from $cuatro,878 thirty day period to obtain mortgage approval. That’s because the fresh new Va allows as much as good 41 % personal debt-to-income proportion, that’s your own monthly loans commission separated by your month-to-month disgusting (just before taxation) income.

- The lender do offset the mortgage payment of the 75 per cent out-of the newest local rental earnings

- 75 per cent out-of $step 1,eight hundred is $step 1,050

- Subtracting $step 1,050 out of your $dos,000 homeloan payment will get you a fees off $950

Called for supplies

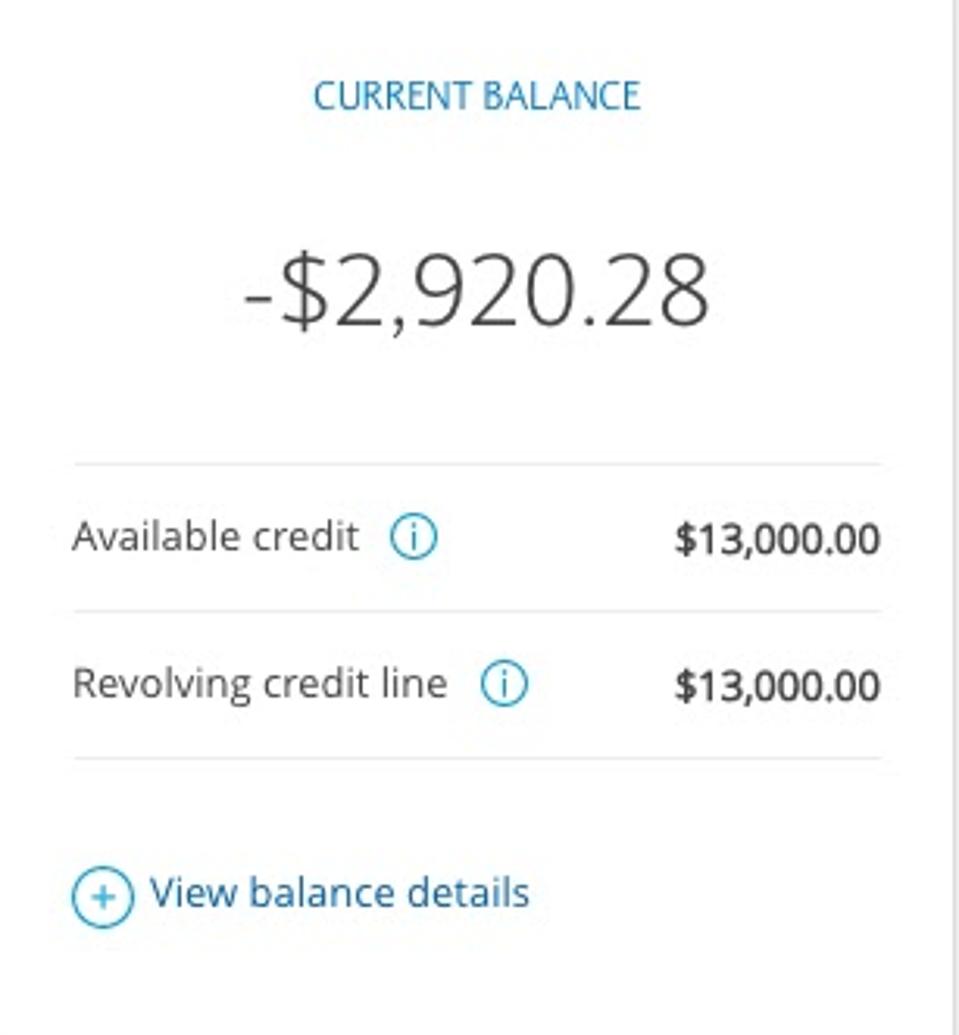

To use the fresh rental earnings otherwise potential local rental earnings having being qualified, you’ll have to show that when closure, you should have deals comparable to six months of one’s overall homeownership will set you back – dominant, notice, possessions taxation and home insurance.

Va mortgage settlement costs

To improve your own reserves after closing, you might have to relieve their closing costs. There are lots of a means to accomplish that.

You could have the seller spend the closing costs in lieu of asking for a lowered price. Like, unlike giving 97 per cent of selling price, create the full-priced provide and ask for a great step 3 % borrowing from the bank to your your closing costs.

You can also get mortgage lender shelter these will set you back within the change to own charging you a high home loan price. Overall, the point (one percent) borrowing from the bank towards the closing costs grows your own interest rate because of the .125 so you’re able to .25 percent, with regards to the lender.

Ultimately, rather than make payment on Virtual assistant investment fee, and therefore makes sure the loan, you could tie it with the amount borrowed. About example a lot more than, the latest financial support commission are wrapped to your financing. So it do improve your percentage, however, allowing your own local rental earnings in order to counterbalance your own payment helps make qualifying easier.

No comment