Regulating treatment

FHLBanks do not restriction exactly how its people explore enhances. not, insurance companies must take into account how critiques businesses determine give-enhancement facts, how this type of software apply at RBC, and exactly how condition rules eters. Advances, in addition to the individuals removed for give improvement, are known as either financing plans, that are mainly specific your insurance companies, otherwise debt. Money plans (deposit-method of deals granted since the general membership personal debt) are managed while the performing power. To possess low-existence companies, improves transmitted once the personal debt may be considered since performing influence in the event that it meet the requirements away from private ratings providers.

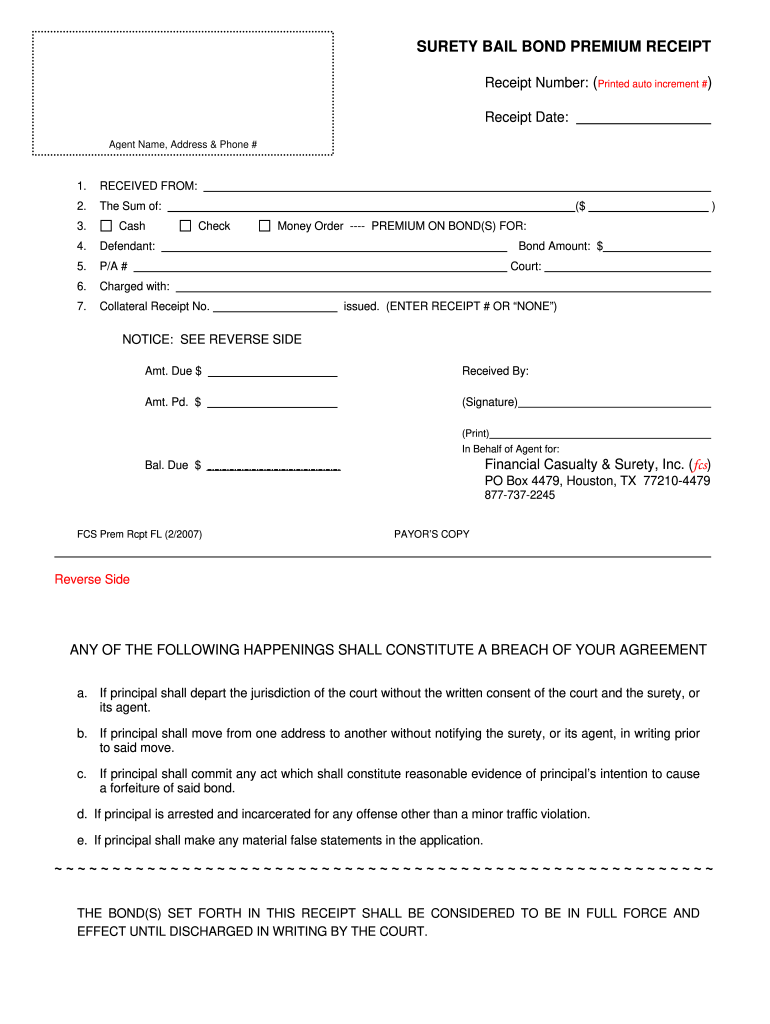

RBC feeling for FHLB spread lending apps will vary from the company range, measurements of improve, posted security, and you will capital allocation. Figure six summarizes potential RBC costs and when the brand new bequeath portfolio is actually spent that have the absolute minimum quality of NAIC 2 and you will an asset blend of fifty% NAIC 1 bonds and you can fifty% NAIC dos securities. Insurance businesses that design a spread financing progress within an effective financing contract, just like the illustrated, make use of a beneficial 2018 enhance to the RBC build: Capital charge is analyzed just to the percentage of security more than and outside the advance number. And when an advance people$100 billion and a security container getting good 10% haircut, a lifestyle insurance provider would have to post You$110 billion altogether equity. The united states$100 billion security number equal to the improvement will not generate a money charges; as an alternative, only the You$ten mil more than-collateralization falls into range to have a keen RBC fees.

When you find yourself insurers hardly compensate over six% out-of complete FHLB member borrowers, typically he has got got a large express off par value enhances since their borrowings tend to be bigger than that from other associate sizes. It is value listing one to insurers’ go from 18% out of par value regarding improves kept into the 2019 to help you 34% from complete enhances held from inside the 2021 lead throughout the blend of a boost in borrowing by insurance companies and you can a beneficial sixteen% miss when you look at the enhances held because of the industrial banking companies season more than season; since converse was correct from spring regarding 2023, insurance company share from enhances has exploded on the 2024, spanning 19% since the original one-fourth. The expense in order to an enthusiastic FHLBank of developing a loan will vary nothing by the loan proportions given that before detailed, very delivering large advances could help insurance providers see relatively beneficial financing words.

Placing loans be effective

Just how is http://www.speedycashloan.net actually insurance companies employing increased FHLB borrowings? Needless to say, into the economic crisis and COVID pandemic, insurers’ exchangeability requires drove a rise within the advances. Exchangeability remains a dominating desire today, having many uses: to cover a great merger or buy, satisfy regulating standards, and serve as an operating-investment backstop. Insurance firms additionally use FHLB loans to deal with and you will mitigate appeal-price or any other dangers, enhance exposure-oriented funding (RBC), get rid of cash drag, fulfill societal specifications, complement ALM stage, and you will arbitrage equity. Such as for instance, insurance providers can get borrow funds so you’re able to protect reinvestment pricing and you may offer the duration of current resource profiles, or even to complete liability maturity holes and you can tense ALM period.

An opportunity for spread improvement

We feel insurance vendors may find make the most of FHLB borrowings when you look at the yield arbitrage, where there’s possibility to earn excessively spread over the price away from an FHLB advance. Profiles prepared with a target away from pass on improvement over the reduced price of a keen FHLB get better may offer choice to possess insurance agencies in order to incorporate alpha otherwise give. (CLOs and you may short borrowing from the bank have even a lot more attract in the a surfacing-speed environment.) Additionally, FHLBanks shall be flexible inside structuring loans, offering a range of choices and additionally name and you may rates alternatives, along with repaired- or floating-rate cost, prepayment, and you will structured solutions.

No comment