Fico scores is actually crucial from inside the creating your borrowing excursion and you can typically dictate their qualification for different lending products particularly personal loans and you may playing cards. A beneficial 650 credit rating belongs to the class off reasonable borrowing score even though so it get is not classified once the bad because of the FICO criteria, it can have specific ventures.

Since ericans had a credit rating less than 650. When you are a 650 rating actually perfect, it’s miles off a-dead stop. In this article, we’re going to discuss different form of loans available to people with a reasonable credit score.

Must i Score that loan Having a good 650 Credit history?

Sure, you could. A credit history out of 650, categorized since reasonable borrowing from the bank, opens the door to different lending products, and mortgage loans and you may automotive loans. Yet not, it is imperative to realize that having which credit score can indicate you can face high interest rates compared to those with increased robust credit users.

Including, a get off 690, which is deemed good credit, typically protects a great deal more beneficial loan terms and conditions. Not surprisingly, particular funds bypass the need for borrowing from the bank inspections, probably providing greatest words for even those with a good 650 borrowing from the bank rating.

Do you really Score a car loan Having a 650 Credit rating?

Yes, getting a car loan that have a beneficial 650 credit history is achievable, but be prepared for high interest levels. In order to teach, in , borrowers having finest credit (FICO rating out-of 720 or more) gotten the typical Annual percentage rate of five.34% to your the fresh 60-times auto loans.

At the same time, those in the fresh new 620-659 credit rating assortment experienced the typical Annual percentage rate out-of %. Costs go higher still getting scores ranging from 590-619, averaging %. It is necessary to note that interest rates may vary extensively one of lenders, for even those with identical ratings.

Particularly for subprime credit sections, doing your research is extremely important. New FICO model prompts rate hunting, provided numerous issues of the identical mortgage types of within this an initial months since one inquiry having scoring aim.

Should i Score home financing otherwise Mortgage That have a good 650 Credit score?

Yes, a 650 credit score is meet the requirements you for a home loan, with many solutions. Which have a rating of 580 or more than, you will be entitled to a keen FHA mortgage, demanding simply a great step three.5% downpayment.

To possess a conventional home loan, minimal credit rating is actually 620 as per Fannie Mae’s criteria. Yet not, all the way down score often incorporate higher standards, such as for instance an optimum 36% debt-to-income proportion and you will a twenty-five% downpayment to own a good 620 score.

While it is you can to obtain a normal loan having because the low just like the 5% down, otherwise 3% occasionally, which normally needs a minimum rating out-of 660.

Ought i Get Personal loans Which have an effective 650 Credit rating?

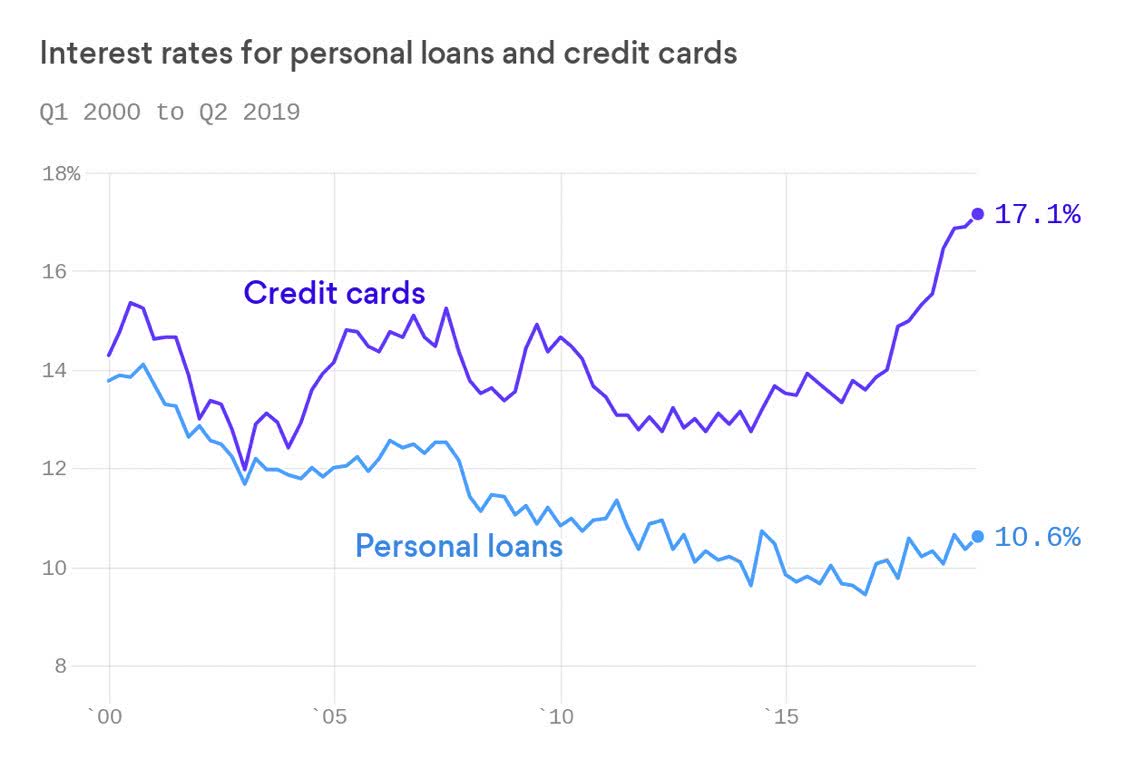

However maybe not availableness the best rates, a beneficial 650 FICO get may be enough to qualify for fair credit signature loans. It is essential to understand that credit history is just one foundation into the loan acceptance. Loan providers think about your revenue and you can full debt membership.

While not common with an unsecured loan sometimes a credit file or credit rating may be needed to locate a personal bank loan.

Even applicants with a high credit scores normally deal with getting rejected when the their existing financial obligation is regarded as an excessive amount of. In addition, difficult borrowing from the bank inspections can get feeling your current credit history negatively and you may credit reports provides its can cost you.

Exactly what Financing Possess Low Credit rating Standards?

Payday loan is prominent because of their minimal borrowing from the bank criteria, which makes them a practical option for short financial assistance. They’ve been small-title finance, and as such, they frequently do not include credit inspections, or at the most, a softer credit check is carried out.

No comment