CalVet Mortgage brokers

You will find the latest CalVet Mortgage will save you money and gives security for your house and you will capital. CalVet has exploded qualification to ensure that most veterans (including people now into the effective obligations) wanting to purchase a home for the California qualify, at the mercy of monetary degree www.paydayloanflorida.net/pine-ridge and you will readily available bond money (see limitations to own peacetime-era experts).

Lots of veterans to shop for property for the California meet the criteria to own good CalVet Mortgage, together with pros which offered during the peacetime. Merely 3 months out of energetic obligation and you may release categorized because the Honotherwiseable or Not as much as Respectable Standards are essential. Recommendations to confirm your qualification was unveiled on your own Certification out-of Launch otherwise Discharge regarding Energetic Duty Means DD214. Experts already into active responsibility are eligible after providing the 90-go out active duty specifications. An announcement out-of Solution from your newest command needs. Latest and you may former people in new Federal Guard, including Us Armed forces Reserves, are qualified from the conference specific standards.

CalVet can help you rating pre-accepted for your get. An effective pre-acceptance confirms you are qualified and economically eligible to good given loan amount. Knowing the sized the loan will help you to in selecting a house and you can settling your purchase.

You could start new pre-approval procedure by submitting a query on line from the CalVet website you can also download the applying and you will submit it by the post, fax otherwise email. Once you’ve received a great pre-recognition, you’ll know how much you could potentially obtain, and start to become willing to purchase your brand new home.

Visit to begin the program techniques. Just after reacting a few pre-determined questions, their program tend to confirm their eligibility. Good CalVet member commonly get in touch with one to bring advice that assist you from the software process.

While already working with a large financial company, ask them regarding the CalVet. When your agent isnt recognized which have CalVet they truly are approved in app techniques.

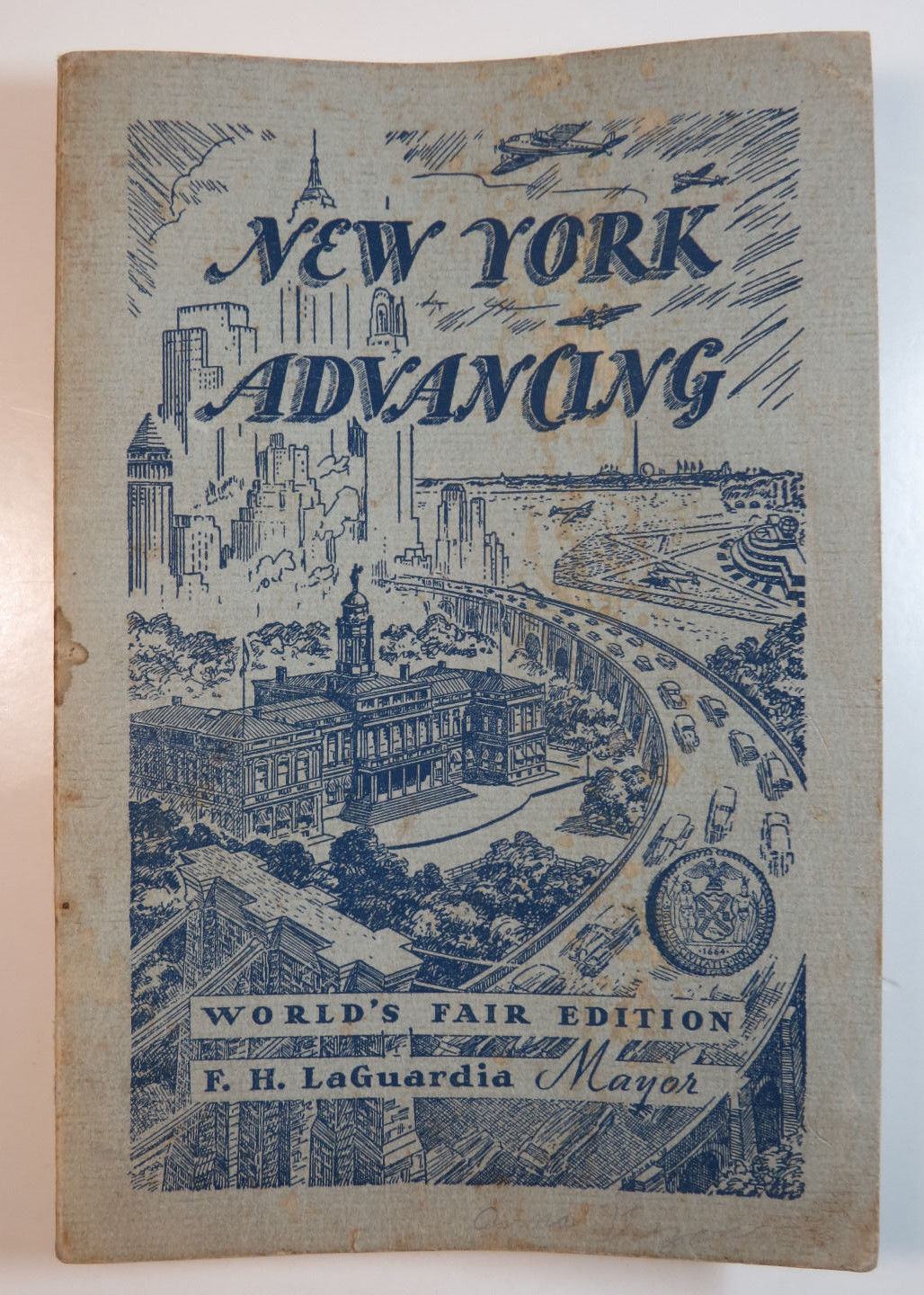

Homes Dated

CalVet’s restrict amount borrowed is dependent upon differing financing has, for instance the financing system or assets type of. CalVet has the benefit of an amount borrowed you to exceeds conventional compliant loan amount limitations. To acquire newest restrict financing amounts, please visit all of our webpages or Call us within 866-653-2510.

CalVet loan fees are typically less than charge energized some other authorities otherwise old-fashioned fund. CalVet only collects an up-front money percentage and does not fees a month-to-month financial insurance premium, that may cost you several thousand dollars over the longevity of the mortgage. If you are using the new CalVet/Va mortgage program together with veteran keeps an excellent ten% or maybe more disability score, new financing fee are waived. Money costs try at the mercy of change. Please go to the fresh CalVet site otherwise refer to them as for the most newest information.

CalVet costs a 1% financing origination percentage on the all the funds. CalVet tends to make your loan less expensive by the maybe not asking even more lender charge.

Their reference to CalVet continues on immediately following loan closing from the repair of loan. CalVet will bring online entry to your bank account. By going to their site, you could register to get into your account online you can also name Loan Servicing from the (916) 503-8362.

The brand new CalVet Mortgage isnt a one-big date work for. Should you have a great CalVet loan previously that was paid-in full due to the fact agreed, it is possible to implement once more.

- Flames & Threat Insurance policies at low category rates

- Crisis Cover To have quake and you will flooding damage high visibility with low deductibles and reduced superior

- Cheap Class Life insurance policy

- Unmarried Nearest and dearest Land

- Organized Equipment Developments (PUD)

- Condominiums

- Are formulated Residential property attached to a permanent foundation

No comment