Of many lenders provides circulated family equity issues and then make upwards to possess age day, consumers still need to be obsessed about the advantages of domestic collateral lines of credit (HELOCs) and contrary house guarantee conversion mortgages (HECMs).

HELOC increase intensifies as the refinances container

Rising interest rates could have led to a sharp lowering of the fresh new re-finance field, but as a way to build new business, loan providers are emphasizing home security lines of credit, which permit individuals so you can tap into home values while keeping the first-lien home loan rates, in lieu of running over to the latest rates.

Turned-off because of the high interest rates themselves, homeowners try, cash loans Trinity in turn, examining HELOCs because of their funding needs and looking so you can power the latest $11 trillion out-of tappable guarantee on You.S.

“Frankly speaking, they will become crazy to give up one first-mortgage price and you may do a special cash-aside refi,” told you Ken Flaherty, elderly consumer lending industry specialist within Curinos. Rather, homeowners try fast become the big consideration out of home loan servicers and you can lenders for their household collateral items.

Household guarantee facts continue to have photo difficulties, survey finds

Customers carry out get higher benefit of house collateral personal lines of credit (HELOCs) and you may contrary domestic collateral conversion mortgages (HECMs) whenever they had a much better comprehension of all of them, according to research by Fund regarding The united states Opposite.

HECMs aren’t well known and you may misunderstandings abound. “Regrettably, the opposite home loan possess a detrimental history,” said Steve Resch, vice president away from senior years services on Much. Meanwhile, HELOCs are usually sold given that backup fund, when they could be used for almost all other purposes, such home improvements otherwise studies will cost you.

“There are various and you will nearly unlimited methods explore [them],” told you Ken Flaherty, older individual lending industry analyst at Curinos. “But that’s the problem. You offer the fresh new range, however you don’t offer the use of as well as the self-reliance.”

HELOC growth at fintechs things to possible change for nonbanks

Family equity lines of credit is gaining high energy certainly fintechs trying to gain benefit from the tool, as the rising interest rates always drive consumers of cash-away refinances.

Fintechs is enjoying big grows inside HELOC originations, for example on Contour Innovation where frequency attained $two hundred mil into the April, double the month-to-month mediocre out of $100 mil inside the Q4 2021.

“Considering the conversations, an enormous percentage of nonbank lenders are trying to ascertain just how to do that unit at this time since the, anyone who has been doing mortgages, the volume possess fell,” said Jackie Frommer, master operating officer off credit within Profile.

Rocket domestic-security mortgage is designed to offset refinancing refuse

This new remarkable shed for the refinancing volume for the reason that highest rates has actually led Rocket Financial or any other independent loan providers to show to new home-equity points to broaden in order to redress the balance.

According to Government Reserve Lender of brand new York, residents features almost $twenty eight trillion equity today, which is tapped to minimize almost every other higher-interest-speed financing.

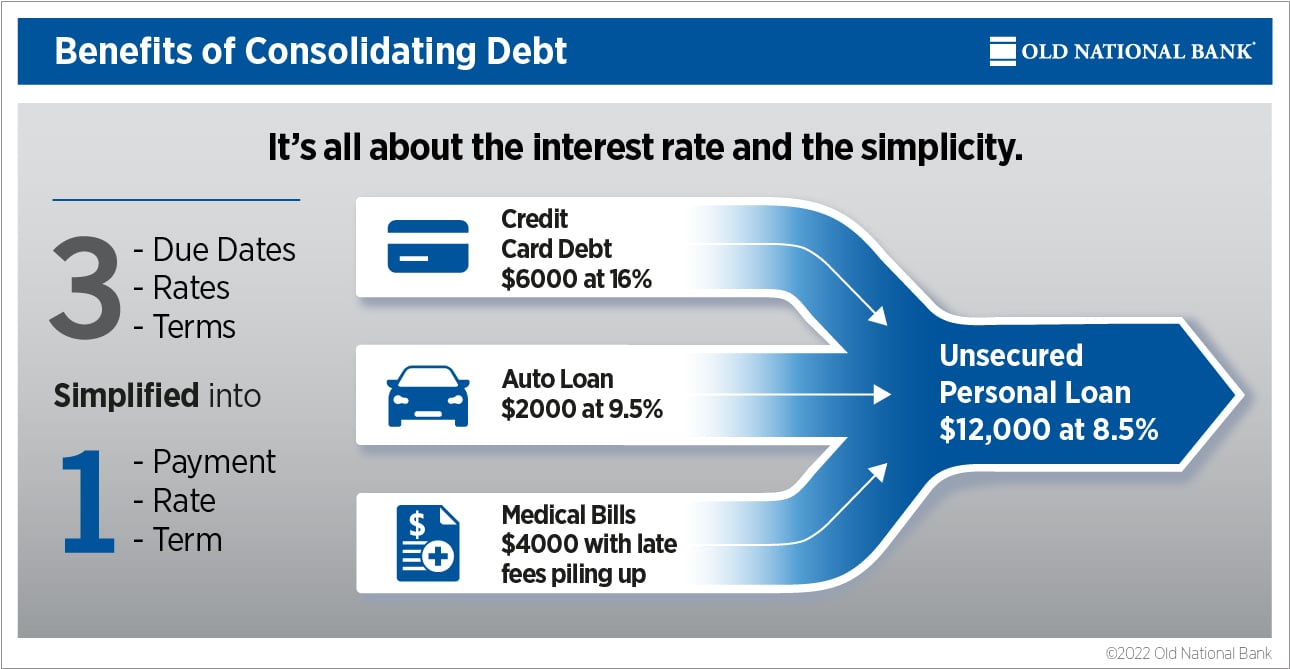

“All of our objective is to constantly create lending products that assist the subscribers reach its specifications,” told you President Bob Walters. “In the current sector, short-identity interest rates provides risen sharply – so it is harder to repay personal credit card debt.”

House guarantee mortgage scam cures tool introduced because of the Basic Western

Mortgage brokers can be guarantee its conformity that have CFPB rules to their responsibility with the vendors they normally use having FraudGuard Household Guarantee, a unique house collateral con avoidance tool.

That have people even more using home collateral issues as opposed to refinancing, Earliest American Study & Analytics’ unmarried-origin product allows loan providers to deal with their access to 3rd-team dealers

“Lenders is measure the exposure on the a possible family equity mortgage on a single centralized unit you to assesses the suitable risk categories,” told you Paul Harris, standard manager, financial analytics at first Western.

Family guarantee financing in order to brief-advertisers right up while the 2021

Hometap’s financing provider lets business owner financial people in order to control the family guarantee in return for a share of your own property’s upcoming really worth, along with evaluate so you’re able to HELOCs otherwise quick-loans, no interest otherwise monthly obligations was due into first 10 age.

“It’s understandable that earlier in the day 2 yrs were extremely hard for individuals, and you may entrepreneurs enjoys presented incredible energy and you may strength regarding face from countless challenges,” said Jonathan MacKinnon, vice-president regarding tool approach and you may business creativity at the Hometap.

No comment