If you would like investment to find and take along side ownership away from an apartment, it’s also possible to sign up for a property financing of HDB or perhaps the loan providers (FI).

Sign up for an HDB Apartment Qualification (HFE) page via the HDB Flat Portal to own an alternative comprehension of their houses and you will financing alternatives before you carry on your home to acquire excursion. It does reveal initial of qualifications to acquire a good the new otherwise resale apartment, together with level of homes features and you will HDB homes financing youre qualified to receive.

Eligibility conditions

Most of the members of the fresh center family nucleus on your own HFE letter software, molded because of the applicant(s) and you will occupier(s) just who allow the domestic meet up with new qualification requirements to your apartment get, have not removed several construction financing from HDB.

* Casing mortgage is not readily available for the acquisition away from 2-place Flexi flats for the brief lease otherwise Neighborhood Proper care Renting. You should pay money for new apartment get using bucks and you may/ otherwise CPF Typical Account deals.

Attention or ownership inside the a house

Youre thought to individual otherwise have an interest in good assets if you have received a house through purchase otherwise when its:

- Received because of the gift;

- Handed down while the a recipient not as much as a can or in the Intestate Succession Act;

- Had, received, otherwise thrown away courtesy nominees; or

- Obtained by waiting on hold believe for another individual/ entity.

The fresh new requirements with the possession/ interest in individual residential and you will low-property apply at every local and you can to another country services which might be accomplished or uncompleted, you need to include but they are not restricted to your after the:

A home, strengthening, belongings which is not as much as a domestic property zoning (along with residential property which have numerous belongings zoning ), Executive Condominium (EC) unit, privatised HUDC apartment and you will combined use advancement .

Age.g. property that have industrial component from the 1st storey otherwise industrial and you may homes E.g. services having a residential parts, particularly HDB shop that have living house or shophouse.

Individual belongings

- Shouldn’t own otherwise are curious about any nearby otherwise to another country individual property; and

- Cannot provides thrown away any individual possessions within the last 30 days, on the court achievement day*, up until the HFE page application.

Non-belongings

All the people and occupiers listed in the latest HFE page application normally, once the a family group, very shopping sites buy now pay later own or are curious about around 1 low-home^ at the point regarding applying for an enthusiastic HFE letter, when they need to get a condo from HDB, a selling flat having CPF casing offers, otherwise a resale Finest Area Personal Housing (PLH) apartment.

^ This is exactly regardless of the show out of possession throughout the non-house. Should your people and you can occupiers individual an equivalent low-residential property, the household is recognized as managing step 1 low-home.

In case your applicants and occupiers individual or are interested in more step one low-home, they have to has actually thrown away the other low-residential properties at the least 31 weeks (measured throughout the legal completion date of discretion of the interest) before you apply to possess an enthusiastic HFE page.

The borrowed funds count will depend on the fresh new the amount the remaining rent normally safety the brand new youngest candidate towards chronilogical age of 95 and you will significantly more than.

Make use of the fee package calculator to find out the brand new payments requisite from the certain goals to buy a separate otherwise selling apartment, and check that you have adequate budget in advance of investing a great apartment get.

The fresh new LTV maximum is the restrict level of casing loan an apartment candidate can take up, expressed due to the fact a share of one’s lower of your own apartment price otherwise value of this new apartment.

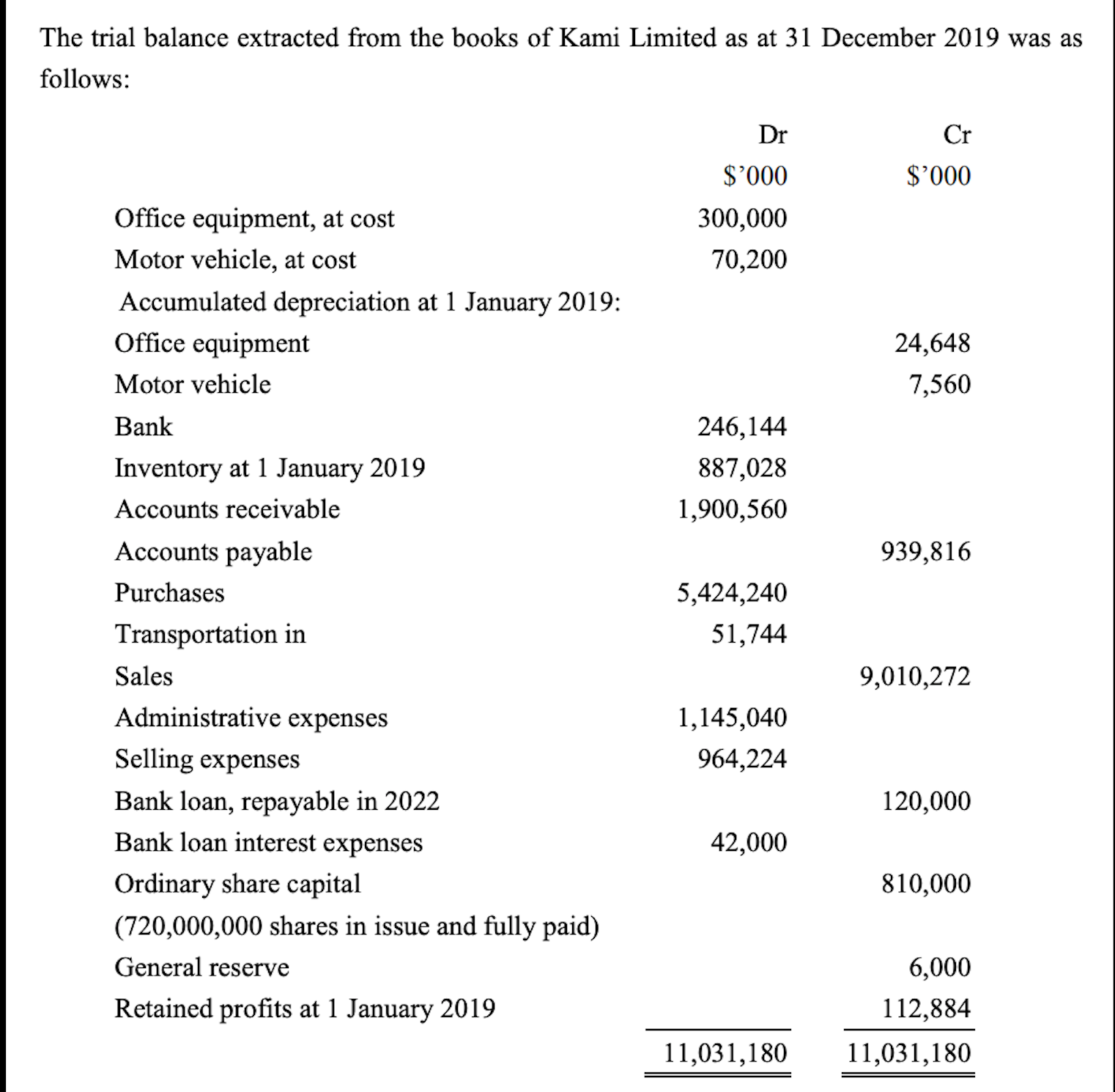

No comment